As 2020 draws to an end, vehicle sales numbers are bouncing back – not quite to pre-pandemic levels, but ahead of expectations for a long-lasting downturn.

Throughout the year we’ve documented how dealerships have changed during the pandemic. We’ve seen widespread use of pickup-and-delivery services, an increase in demand for contactless contract options, and more recently, new technology solutions aimed at simplifying and personalizing the dealership experience.

All of these tactics and tools were aimed, earlier in the year, at maintaining revenue during the worst sales year since the 2008 recession. Now, thankfully, uncertainty about sales and revenue in the auto industry is abating. That doesn’t mean, however, that sales and service will return to their pre-pandemic normal.

Instead, consumer expectations have permanently shifted. Customers expect out-of-dealership offerings and modern, digital interactions with their dealerships. The success of new-age retail models like Carvana’s, and dealer groups’ like Lithia’s embrace of online retail tools make it clear that success in 2021 and beyond will depend on giving consumers more opportunities to dictate the process and timeline through which they purchase a new car.

Dealerships have an immediate opportunity in changing the way they view the sales lifecycle. Sales processes do not begin with the first dealership visit (or website visit). Instead, the sales cycle starts the moment customers express interest in a new vehicle purchase, and that’s most likely to happen not in the showroom, but in the service department.

The Loaner

Customers view loaner vehicles as test drive opportunities. We’ve repeated this point frequently since research conducted by J.D. Power found that 75% of customers will be thinking, while they drive a loaner, of how that newer vehicle and its newer features fit into their daily life.

Dealerships need to recognize loaner programs as opportunities to familiarize customers with new products and the trajectory of innovation at that manufacturer. Dealerships can also create tiered loaner programs in order to collect additional information about their customers (while simultaneously generating revenue that can offset the costs of a loaner program).

For instance, a customer who arrives in a crossover and is willing to pay for an upmarket SUV loaner might be interested in upgrading from their current vehicle to one more capable, spacious and luxurious. Passing information about that customer’s loaner experience to the sales team can help them develop better-targeted marketing messages and potentially guide the customer into a new purchase process.

The Test Drive

Ever an integral part of the purchase experience, test drives are another arena where dealerships can rethink how they meet customers’ needs for evaluating a major purchase. Recent research indicates that a new emphasis on providing more flexible test drive options and at-home sales and delivery processes could present a major opportunity for dealerships.

Ninety-eight percent of respondents to a J.D. Power survey said they were more likely to purchase a car after an extended test drive, while 75% of car shoppers who were nearing a purchase told KPMG they would want to complete paperwork and take delivery outside the dealership.

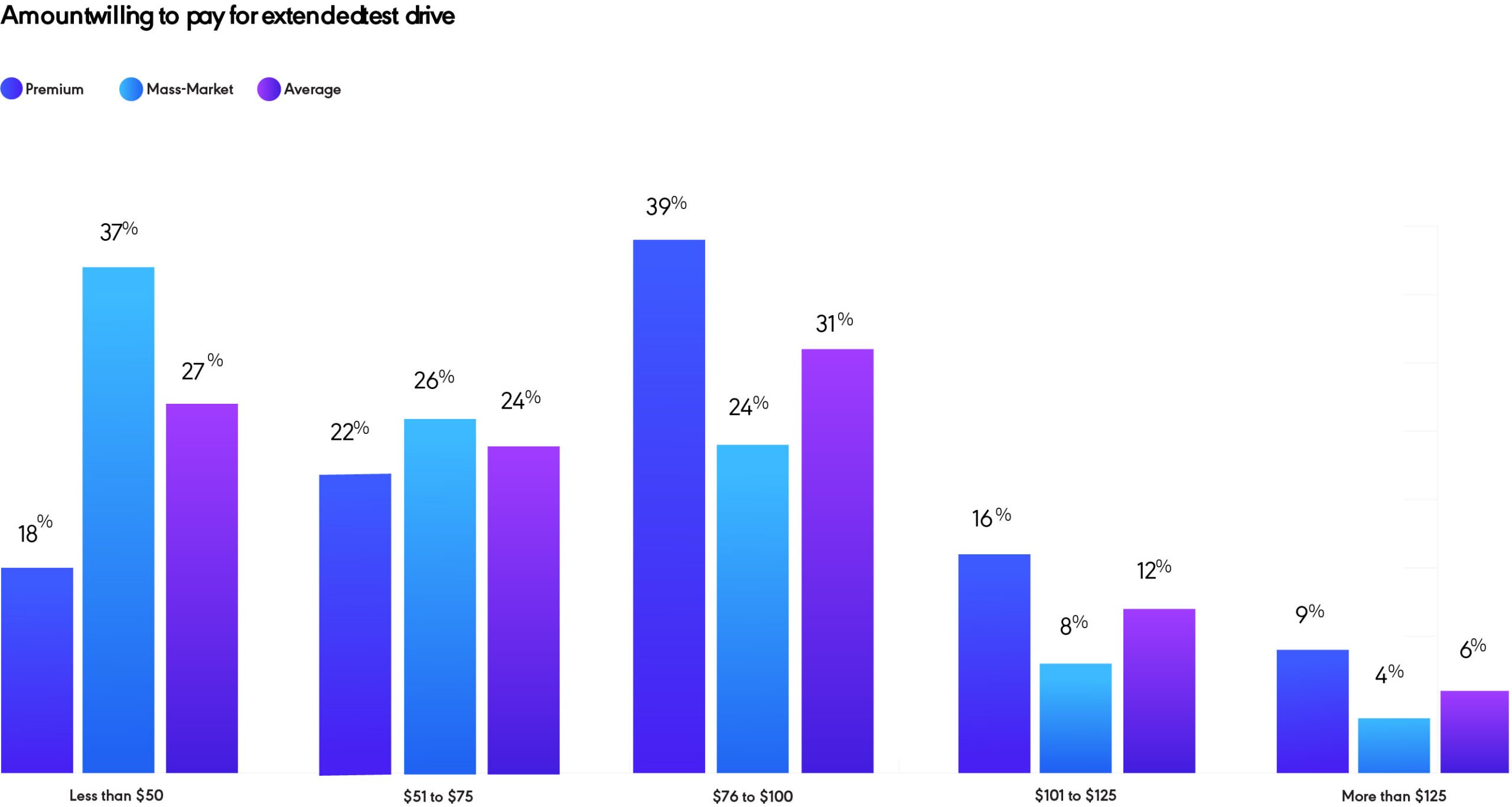

Providing customers with ways to experience a new vehicle in their day-to-day life might contribute to simpler and more successful sales interactions. Furthermore, dealers don’t need to assume all the risk of extended test-drives or self-guided, at-home test drives. Surveys show that most consumers would be willing to pay between $50 and $75 for an extended test drive.

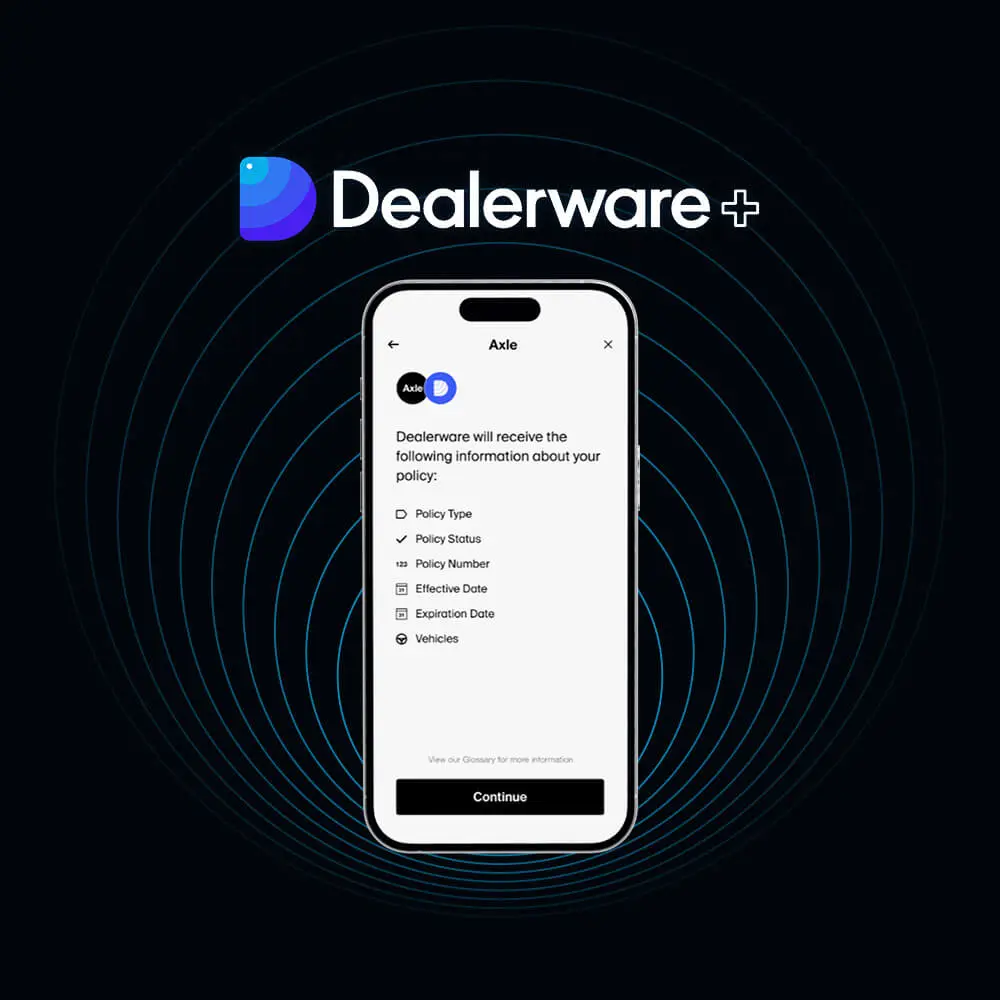

Dealers can further protect their demo vehicles by managing them like loaner cars, using loaner contracts to pass liability to customers, especially for extended test drives. As an added benefit, demo vehicles managed with Dealerware can automatically recover fuel and toll costs, further reducing the impact of more flexible test drive options.

For more information on how Dealerware can help manage loaner, test drive and other fleet vehicles, contact [email protected] or click below to schedule a demo.