Well-managed loaner fleets can impact the Service Department experience and customer satisfaction with a dealership. That can translate to future sales, too. In research with J.D. Power, Dealerware found that 75 percent of car owners viewed their loaner experience as a test drive, and 70 percent said they would return to purchase a car from a dealership that offered a loaner vehicle during service.

But loaner fleets don’t come without costs, in fact, Ward’s Automotive reports that loaner fleets typically are the third-highest item on a dealership’s profit and loss sheet, behind real estate and staff. And when customers have accidents in loaner vehicles, costs add up more quickly. The cost of repairs is one element, but dealerships must also deal with Loss of Use of that vehicle while it’s being repaired.

Let’s consider some common missteps in loaner fleet management that can cause extra headaches when recovering damage costs. Then, we’ll look at best practices that can help reduce the time and stress required to get courtesy fleet vehicles fixed up and back on the road.

Put “Paper” work First

The best time to prepare for an accident is before your customer even takes the keys to a loaner car. Great contracting processes can prevent losses later. Consider this example:

At Bob’s Car City (not a real dealership) every customer who takes a loaner car is only advised to keep a personal vehicle insurance card with them when driving the vehicle. When things get busy, vehicle walkarounds often get skipped.

As you would expect, when the inevitable happened and one of Bob’s customers had a fender-bender in a loaner, the dealership was faced with a big problem. Rather than admit to being involved in an accident, the customer reported that the car was damaged when they picked it up.

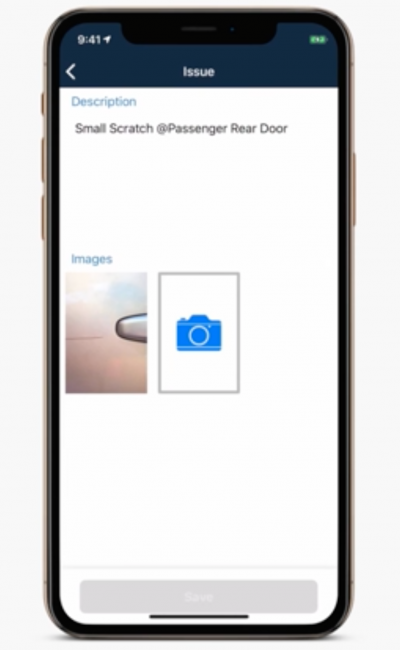

Bob’s Service Manager knew this wasn’t true. But unfortunately, he discovered that a Service Advisor forgot to fill out walkaround details before the customer left with the loaner car, and forgot to take photos of the car before checking it back in as part of the dealership’s standard process. As a result, the dealership couldn’t prove that the damage occurred while the vehicle was under contract with the customer.

Bob’s has since taken its photo inventory process more seriously by photographing every loaner vehicle before they return it to inventory, and while the customer is still at the dealership. This way, they can talk with customers about apparent damage the moment it’s noticed, and they have a more reliable backlog of vehicle condition notes for reference.

Now every Bob’s Car City employee knows they should gather essential information before a customer ever leaves with a loaner:

- Driver’s License Copy

- Current Insurance Policy Copy

- Credit Card Information

- Vehicle Photos

- Signature on Loaner Car Paperwork

They also know that cost recovery gets more complicated if a service employee lets a customer leave before fully closing their contract, doing a vehicle walkaround, and charging their card. The best way to recover costs and maintain good relationships with your customers is to handle payments while they’re still at the dealership.

Handling the Inevitable

We don’t live in a perfect world with perfect people, and accidents will happen. Software like Dealerware will prevent you from starting a contract with a customer without gathering the required information and makes it simple to attach vehicle photos and collect signatures right in the service drive, so you’re protected in the event a customer has an accident.

Often, customers will let you know if a vehicle was damaged while they had it, and you’ll be able to walk around the vehicle while noting any damage with photos, videos, and the customer’s account of what happened.

However, there will be times when a customer was involved in a situation that caused damage to your vehicle, and like the example above, they won’t be so forthcoming.

It’s a difficult situation, for sure, but using the photos and video gathered before the loaner delivery and the signed documents will help keep your dealership from accepting unneeded liability. Presenting this evidence to your customer with a gentle but assertive request for fair treatment will be helpful. And it’s also essential to explain the process and fee required to repair the damage.

If your customer refuses to acknowledge their liability, or if attempts to collect payment fail, having software like Dealerware also ensures you have the correct driver’s license, insurance information, and signed documents needed to provide the insurance company with evidence that the customer was responsible for the damage. This way, you can get an insurance adjuster out to the dealership more quickly and begin repairs sooner, too.

In these cases, it’s also strongly recommended you work with your dealership’s legal counsel before taking further action. Be sure you have the customer’s signed rental agreement and photo and video evidence of the damages.

Service Doesn't Require Sacrifice

Good CSI scores are essential, and research shows that offering loaner cars will bring higher RO values and customer satisfaction rates. With Dealerware’s mobile contracting tools, you can provide the fastest, most user-friendly loaner experience on the market. Everything from credentials to payments is handled on a mobile device, and Dealerware is the only fleet management platform that’s PCI Compliant on mobile and web. Additionally, Dealerware’s automated contracts are approved by all major fleet insurers.

Dealerships discover that Dealerware helps increase CSI scores by an average of 27 points more than what they get with other fleet management programs. Your customers want simplicity, and you want to have better utilization and cost recovery. Only Dealerware can provide you the confidence of better customer service, better tools, and cost recovery of your loaner fleet.

Contact us to unlock all you can do with loaner fleet management.