Throughout much of 2020, we witnessed an exponential decrease in how many drivers were on the road, which also meant fewer drivers were scheduling service appointments with dealers. However, according to a recent study by J.D. Power, dealer service visits were down only 6% from a year ago. Survey data shows that dealership service departments are finding ways to stay resilient and continue to increase customer service index (CSI) scores despite tough times. Overall customer satisfaction increased from 837 to 847 (on a 1,000-point scale) which contributed to a sixth consecutive year of increased overall satisfaction.

In this hyper-competitive industry, increasing CSI scores is crucial. But what do customers find most important to their experience, and what leads to higher satisfaction scores? In this post, we want to show how Dealerware can help you improve in some of the areas that J.D. Power explains are most impactful to CSI scores, so your dealership can continue to delight customers and keep them coming back for service.

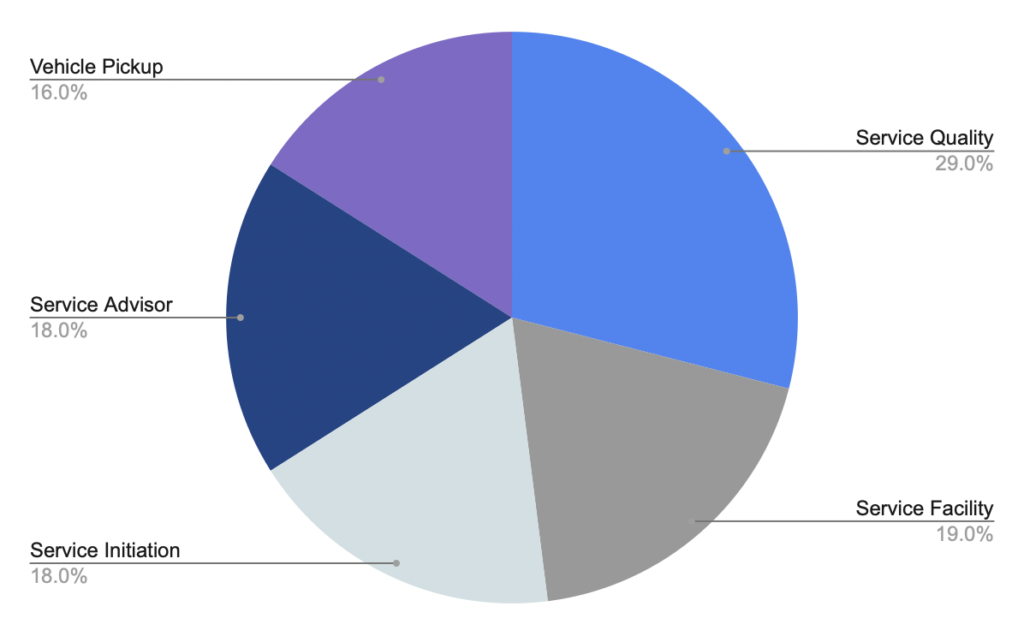

JD power outlines five measures that contribute to the overall vehicle service experience, (In order of importance) service quality is first (29%), followed by service initiation, the process of completing a service from start to finish (18%); service advisor (18%), and vehicle pick-up (16%). “Completing work right the first time, as well as focusing on customers’ needs, play significant roles in satisfaction,” said Chris Sutton, vice president of automotive retail at J.D. Power.

Dealerware customers report an average CSI score increase of +27 points after implementing our platform. This can be attributed to a streamlined and more enjoyable overall service experience for dealership customers: Dealerware’s mobile contracting and payment tools on average reduce by 90% the time it takes to get a customer into a loaner car.

Dealerware’s app experience is so fast because we’ve built a user-friendly interface that centralizes everything you need to create contracts through a single pane of glass. You can scan drivers’ licenses to automatically capture customer info, snap a quick picture of insurance info, then take photos or video to document the condition of the loaner vehicle before and after a contract. This all-in-one mobile packing means customers have to spend less time working with dealership employees, and the dealership can keep their fleet moving more volume.

Fast contracting works anywhere on Dealerware, too, so you can meet customers with a loaner at their home or office, provide pickup and delivery service and complete the entire transaction from a mobile device – Dealerware is the only dealership fleet management tool that’s PCI compliant on mobile, so you can accept payments with confidence. This workflow hits several of the J.D. Power areas for CSI success, namely great service initiation and vehicle pick-up. Plus, J.D. Power found satisfaction scores improve 44 points among premium customers who pay remotely or online.

Finally, elevating the overall experience for dealerships’ customers partially relies on transparency between the customer and the dealer. When a customer is surprised by the final cost of their loaner, they are likely to be dissatisfied with their experience. Dealerware prevents end-of-contract surprises with simple-to-read mobile contracts that use agreement toggles to ensure a customer reads and understands the terms of their loaner. At the end of the contract, customers will expect to be charged for fuel they didn’t replace or tolls they incurred, eliminating unwelcome surprise costs or pre-empting customers to fill up the tank before returning to the dealership.

While integrating software like Dealerware mobile into your business can simplify the service process for dealers and their customers, it’s only efficient if dealers can become experts at using the software, and if they can quickly get support from us when they need it. At Dealerware we provide dealers with easy-to-understand training from our support team, and our training program has a 98% satisfaction rate. We give dealers everything necessary to start using our platform within a week of starting the process. We also take pride in our 24-minute average response time for customer service inquires, minimizing the stress on dealers when they need help.

When service quality, facility, initiation, and the advisor all play an important role in the customer experience, incremental improvements can make a big difference and in the long run, lead to higher CSI scores. At Dealerware we know how important these scores are for dealerships and we want to provide you with the best tools to make loaning vehicles more enjoyable for dealers and customers alike.