Great loaner or rental programs generate revenue. Or, particularly for premium brands who cover their customers’ fuel and toll charges as an extra courtesy, the costs of providing that courtesy service are easily measurable so the business understands the true cost of retaining service customers.

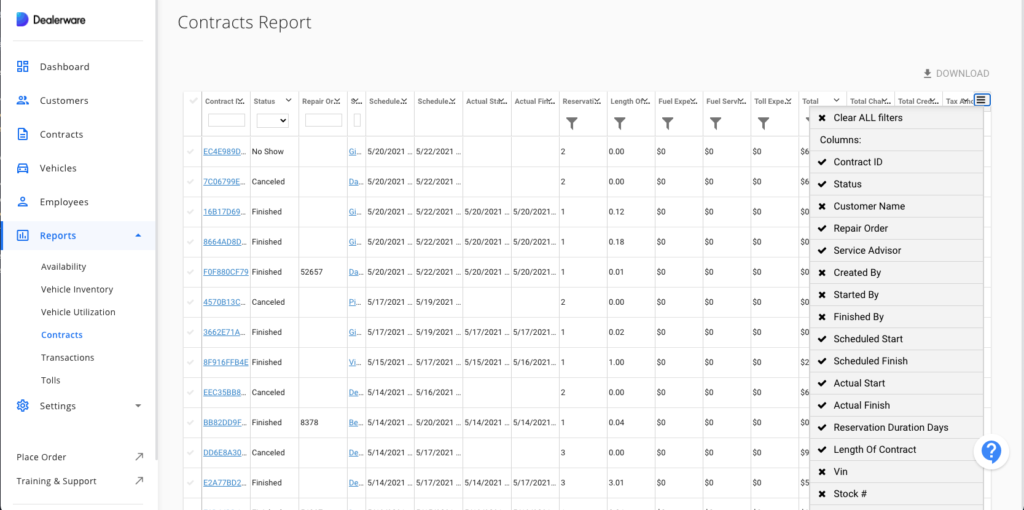

It’s difficult to meet these benchmarks without a way to quickly and easily review your costs, revenues, sources of business and much more detail about the financial performance of your fleet. Where other vendors may leave you with the work of collecting data from multiple different reports, Dealerware’s approach is to centralize data and provide simple tools for searching and sorting that data. Then, if you want to dig deeper, you can work with even more granular detail in downloadable reports.

In this post, we’ll look at the Dealerware reports that our Customer Success team feels are most important for staying on top of your fleet’s financial performance: Contracts, Tolls, Transactions and the Unsettled Balances reports.

Contracts

Dealerware’s Contracts report sits at the center of all your fleet’s data – information about each car and customer is tied back here, so you can understand how each contract contributes to your program’s success.

There are nearly 50 fields by which you can sort the Contracts report, including fuel used per contract, fuel charges, credits, damage adjustments, warranty adjustments and more.

This report can be helpful in evaluating strategic changes, like instituting cost recovery measures if you don’t already recover fuel and toll costs from your customers.

We know that the time needed to refuel vehicles returned empty is often a more obvious pain point than the actual cost of fuel. But take the total Fuel Difference from Dealerware’s contract report and multiply that by the price of gas at the nearest pump. Once you shine a light on it, that hidden cost of buying fuel that your customers used won’t be so easy to wave off.

Consider the costs a 20-car fleet can accrue at even a 60-percent utilization rate. Even if you only need to add a gallon to each car after each of the 360 contracts you’ll complete in a month, you’re likely to be spending $1,000 and nearly 100 hours each month just refilling your vehicles.

The same strategy can be applied to other costs like mileage or tolls, and using the Contracts report to track credits back to customers can also help you identify imbalances between your team members. If one service advisor chronically credits costs back to customers, perhaps it’s worth talking over dealership policies with them again, or making sure they’re reviewing costs while they’re still with the customer. Waiting until after a customer has left to check a car back in and close the contract is a common mistake, and service advisors who do this are more likely to waive charges instead of billing customers.

Tolls and Transactions

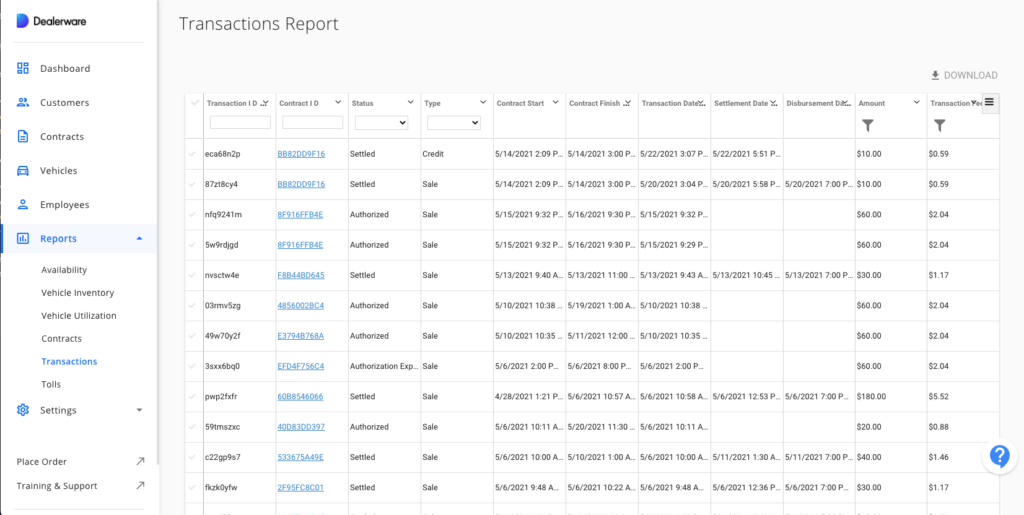

The Tolls and Transactions reports are great places to answer questions, and they complement or supplement the Contracts report’s enormous lens by narrowing your focus a bit.

Has a customer disputed a toll charge? You can use the Tolls report to confirm the date, time and location a toll was incurred and check it against contract details.

Taking a broader view, the Tolls report can also show you every toll incurred by a vehicle while it’s been in your fleet, or help you quickly find the sum of all toll charges for a given period of time.

Another reason you might use the Tolls report is to ensure that toll transponders are assigned to the correct vehicles.

Especially when cycling vehicles in and out of your fleet, you can use the Tolls report as a checklist to make sure your Toll tags are removed from vehicles being disposed, and then that you correctly record the stock number or license plate of the new fleet vehicle in which you reinstall the toll tag.

If the Tolls report helps you answer questions about what has happened, your Transactions report is more of a crystal ball. One of the main ways dealership, dealer group and OEM financial reporters use the Transactions report is to determine how much to expect in their reimbursement check from Dealerware. Or, Transactions can help you track credits against sales, so you can continually measure your fleet’s financial performance and easily build profit and loss statements.

Unsettled Balances

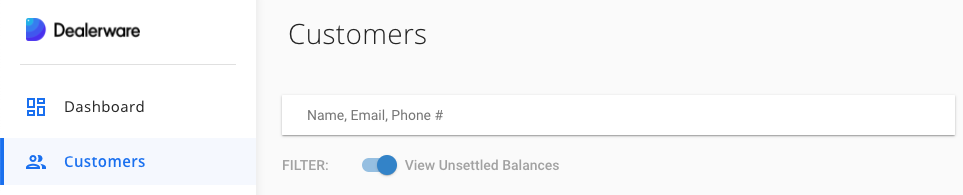

Finally, the last of Dealerware’s key financial reporting tools isn’t exactly a report. Navigate to the Customers tab within Dealerware and at the top of the page, you’ll see a toggle switch that says “View Unsettled Balances.”

This sorting function allows you to quickly identify charges that haven’t been credited or settled with customers, right alongside their contact information.

Our Customer Success team recommends checking your Unsettled Balances before the end of each day, so that you can reach out to customers and close out charges left unsettled before it feels too late.