Running a service department means juggling tight schedules, limited staff, and high customer expectations—especially when managing a small courtesy or loaner fleet. With just 5–15 vehicles, every car matters. That’s why more service directors are turning to Dealerware+ to simplify operations, recover costs, and deliver better customer experiences.

Take Control with Real-Time Fleet Visibility

With Dealerware+ Connected Car Solutions, you get real-time insights into your fleet—know where each vehicle is, how much fuel is in the tank, and how many miles have been driven. That means no more guessing when a vehicle will return or whether it’s ready for the next customer.

Dealers using Connected Car Solutions report:

- 20% faster vehicle turnaround times

- 30% reduction in idle fleet days

- Fewer customer complaints about wait times or vehicle availability

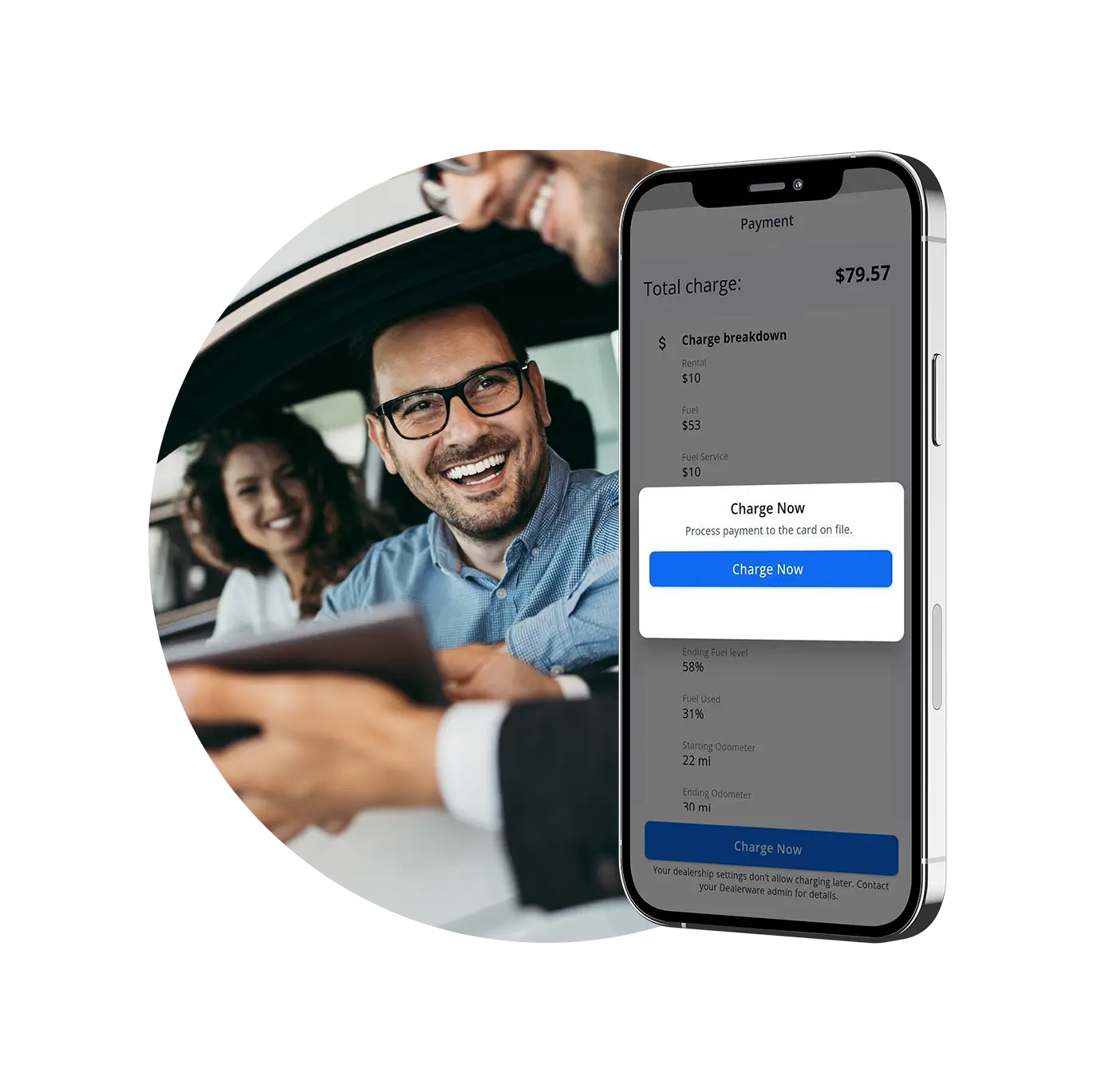

Save Time, Recover More

When your team is stretched thin, saving even a few minutes per transaction matters. Dealerware+ helps service advisors complete digital contracts in under a minute, thanks to integrated ID scanning, payment capture, and automatic fuel and mileage tracking.

On average, Dealerware customers recover:

- $65–$90 per vehicle per month in fuel, tolls, and mileage

- Hundreds of dollars monthly in avoided toll violations and late return penalties

- Up to 10 hours per week in time saved on manual reconciliation

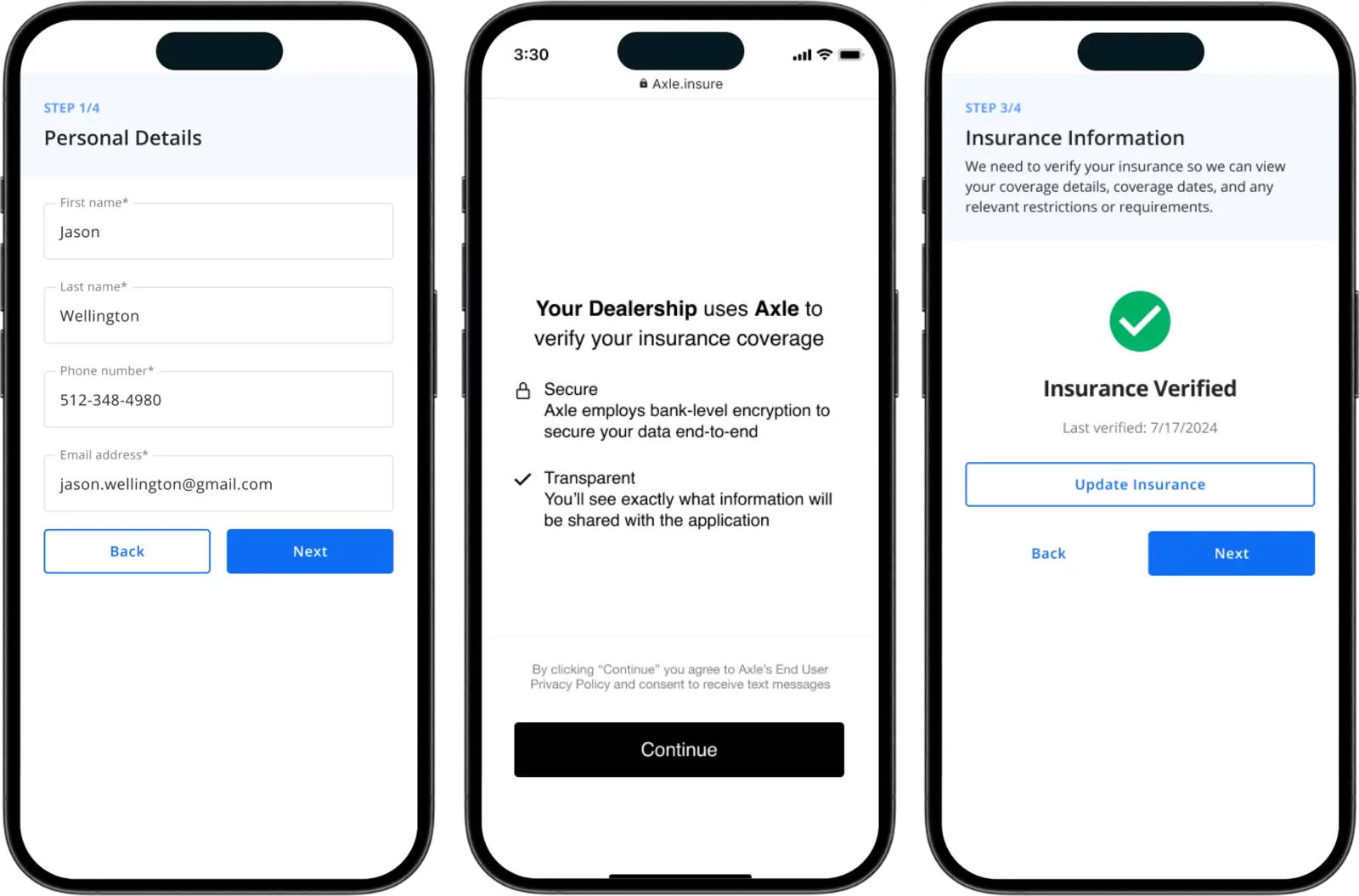

Reduce Risk with Insurance Verification

Accidents happen, but your department shouldn’t carry the liability. Dealerware offers automated Insurance Verification at check-in—so your team can confirm coverage, reduce manual paperwork, and confidently hand over keys, knowing every vehicle is protected.

This feature also:

- Improves contract compliance

- Lowers the risk of insurance-related disputes or claims

- Reduced verification from 20 minutes to under 2 minutes

Go Digital, Stay Secure

Dealerware eliminates the need for paper contracts and filing cabinets. All customer and vehicle data is securely stored and encrypted in the cloud, helping your store stay compliant with data privacy regulations and reducing the risk of lost or mishandled information.

More Uptime. Happier Customers. Fewer Headaches.

Dealerware helps small fleets run like large ones—automated, efficient, and always customer-ready. With streamlined workflows, faster check-ins, and built-in protection, your team can focus less on chasing cars and paperwork—and more on delivering exceptional service.