In the last month, one of the most common questions asked and answered through our support site was “What are unsettled balances and how do I manage them?” The quick guide available on support.dealerware.com provides step-by-step instructions, but we thought we’d expand on some of the best practices around balance management here.

For any question you might have about how Dealerware works, or how to use the platform to accomplish specific fleet management, billing or reporting goals, we’ve probably got a detailed answer on the support site. For fast help, check support.dealerware.com

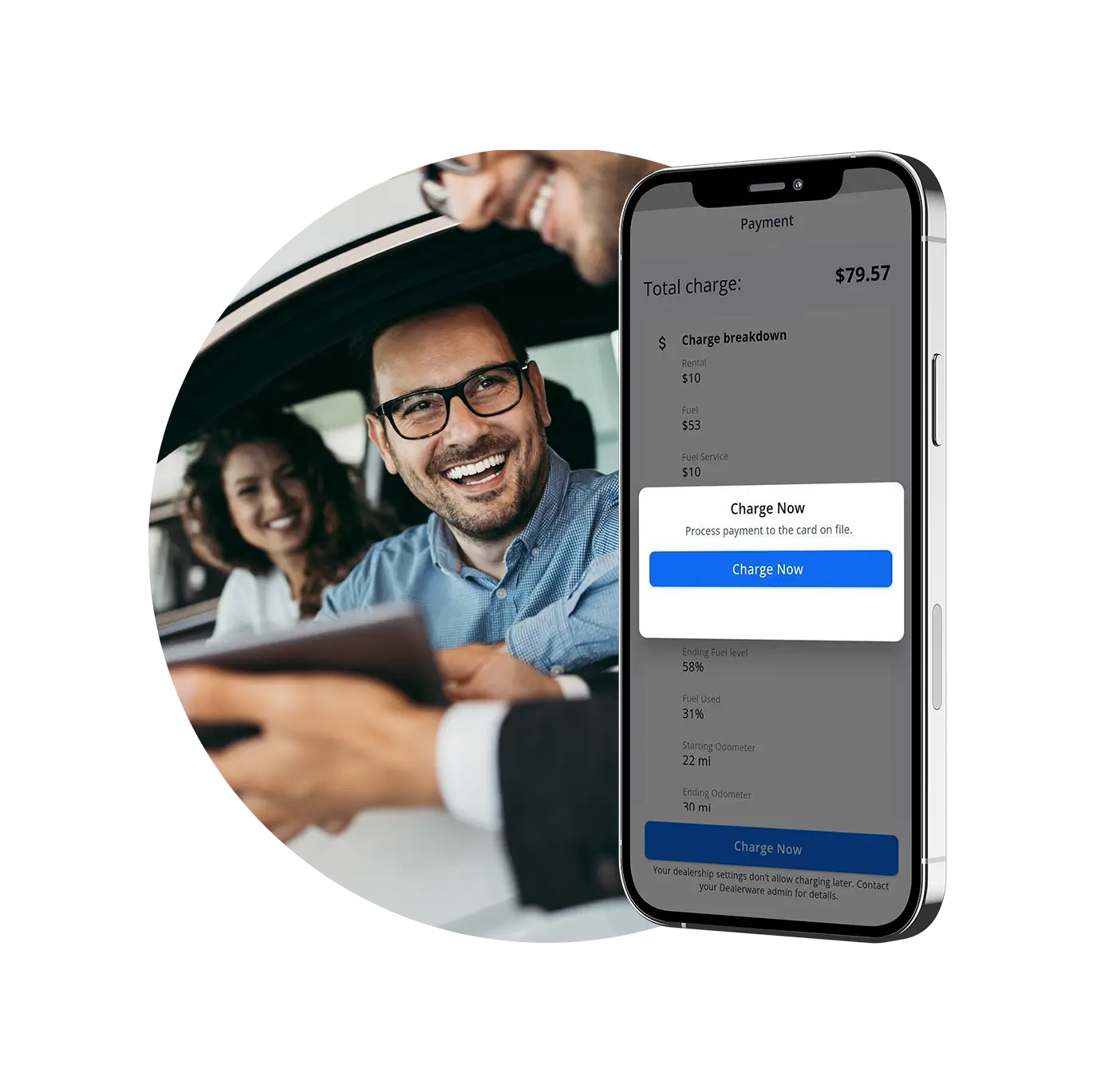

Unsettled balances are charges that your customers haven’t paid yet. We encourage Dealerware users to charge customers before they leave the lot. While our easy-to-read mobile agreements reduce the likelihood of disputes, it’s always easier to handle pushback from customers in person.

Balances are left unsettled for one of four reasons. Let’s take a closer look at each of those reasons, why balances are often left unsettled, and what the best practices are to maximize cost recovery:

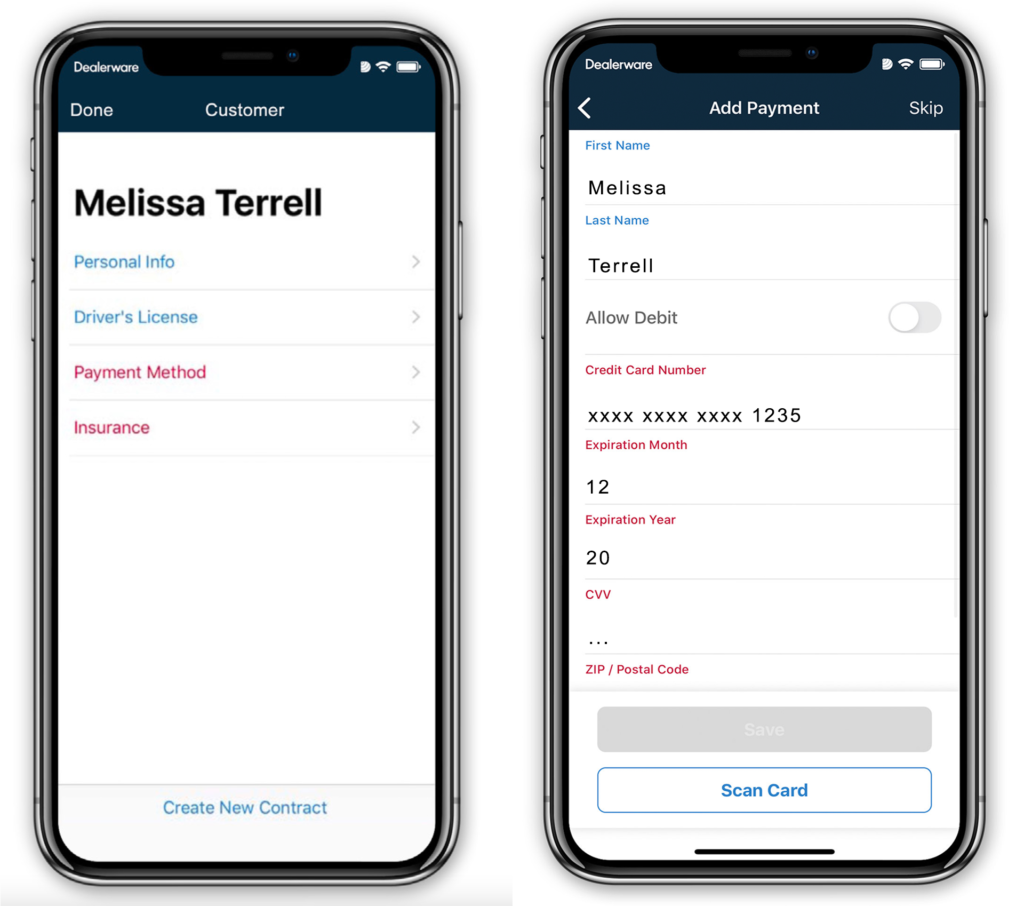

The dealership employee closing the customers’ contract used the “Charge Later” feature in Dealerware Mobile instead of “Charge Now.”

You might choose to do this if the service department is overloaded and time is short, or if a cleaning fee or other additional fee needs to be assessed before you can charge the customer. In the vast majority of cases (especially when things are busy and you feel rushed), you want to charge customers immediately upon closing contracts.

The dealership employee closing a contract in Dealerware Web did not charge the customer.

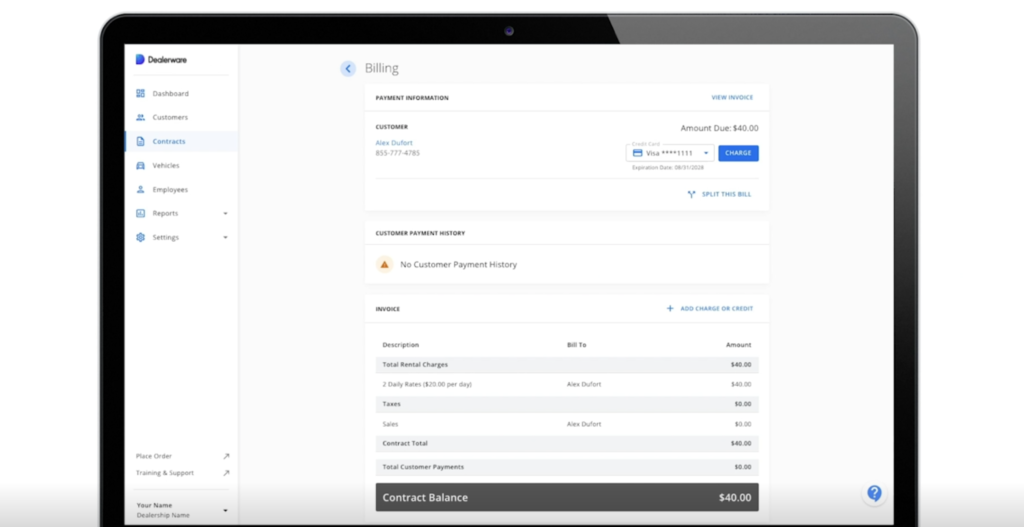

Most contracts are opened and closed on Dealerware Mobile, but in some situations, Dealerware Web may be used to open and close contracts. When doing so, it’s important to remember that you need to hit the “Charge” button on the “Billing” page in order to actually collect payment from your customer. We require users to hit “Charge Now” on Dealerware Mobile and “Charge” on Dealerware Web to avoid errant charges to customers.

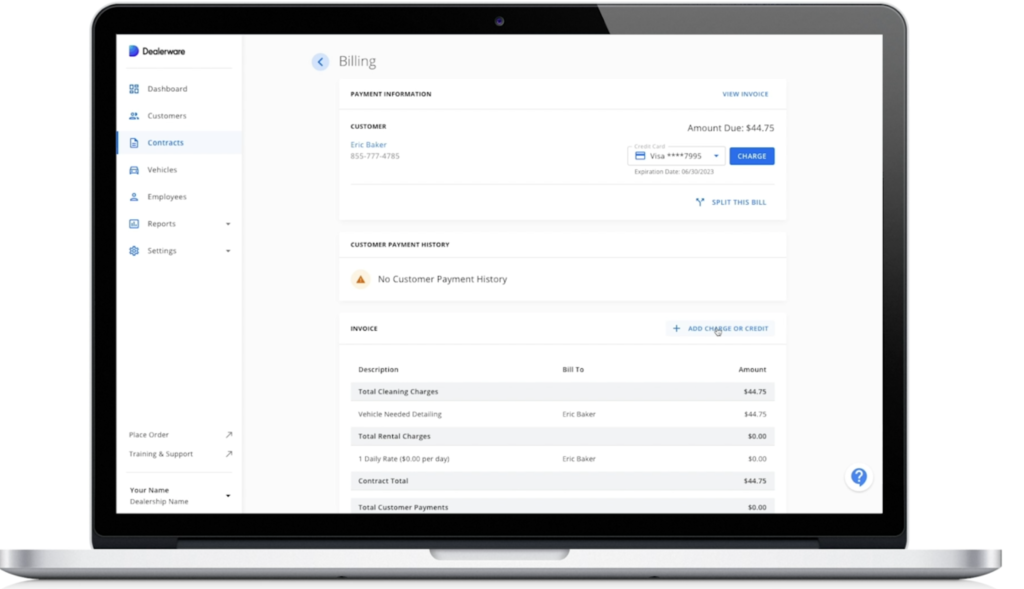

The customer invoice was edited but they weren’t charged the new balance.

Sometimes dealership employees may decide to add charges after a customer has left — maybe a cleaning fee — and will edit the customer invoice to reflect the new charge. As with the previous cause of unsettled balances, invoice edits won’t actually be billed to your customer until you complete the process by hitting the “Charge” button. It’s recommended that you discuss invoice changes with your customer before making them. Once the changes are made, you again need to click “Charge” to collect payment. This measure protects you and your customer from errant charges.

The customer’s payment card was declined.

If a customer’s payment provider declines the transaction, whether due to insufficient funds, card expiration or card cancellation, you’re left with an unsettled balance. This is another reason why it’s important to charge customers while they are still at the dealership, so that you can collect new payment information if their card on file is declined. To remedy a declined transaction after a customer has left, you’ll need to get in touch with your customer to update payment information with them. Importantly, before a contract is started, Dealerware automatically checks that payment cards are active, so a customer can’t give you an expired or canceled card from the start.

How to recover Unsettled Balances

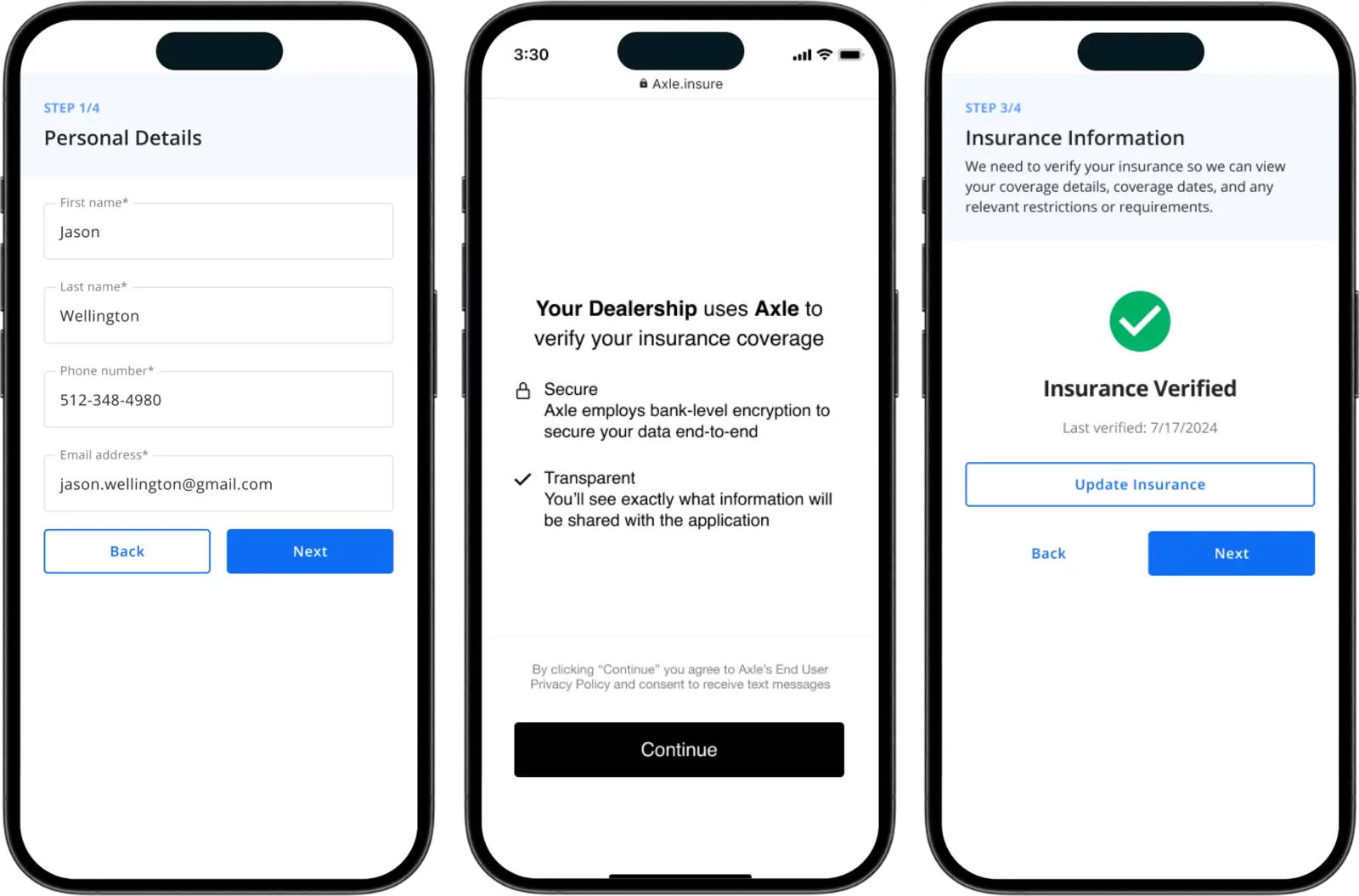

Now that we understand why customer balances are left unsettled, what do we do to manage those balances? In Dealerware Web, only users with “Accounting” permissions can make changes to invoices and charge customers, so be sure to check your permissions before trying to address unsettled balances. Talk to your account administrator if you need to be granted accounting permissions.

There are two options for dealing with unsettled balances: charging or crediting your customers. Charge your customers to recover their contract costs, or credit them to cancel their balance.

To credit customers, Dealerware users should navigate to the Invoices section of the Billing page under the contract with an unsettled balance. Select “Add Charge or Credit” and choose “Credit” as the adjustment type before categorizing the credit and entering the amount to be credited back to the customer. This will appear on the customer’s receipt, which will be sent to them via SMS once you press “Charge,” after completing edits to their invoice.

To charge customers for unsettled balances, you’ll begin on the same page, the Billing page under the contract with an unsettled balance.

You can charge the customer the full amount owed by simply clicking the “Charge” button in the top right corner of the page, or you can adjust their contract with additional charges or credits, as described above.

For balances that have been left unsettled for longer than a day or two, it’s important that your first step is communicating with your customer, so they’re not surprised by the charge. This is why we always recommend that unsettled balances are managed every day. No matter what caused the unsettled balance, it becomes more difficult to recover contract costs as time goes by.