De-risk Your Fleet Programs with Dealerware+

Dealerware+ de-risks fleet programs by providing solutions to track and protect your assets, receive customer payments upfront, and maximize program reimbursement.

As vehicle prices reach record highs, managing a courtesy vehicle program has become increasingly complex and risky for dealers. Tracking these high-value assets can feel like a full-time job without the right software tools. From monitoring vehicle location and usage to recovering fuel, toll, or accident repair costs, dealers face mounting challenges. What’s more, maintaining program compliance is critical to maximizing incentives. The right fleet management solution can help dealerships automate processes, mitigate risks, and protect their bottom line.

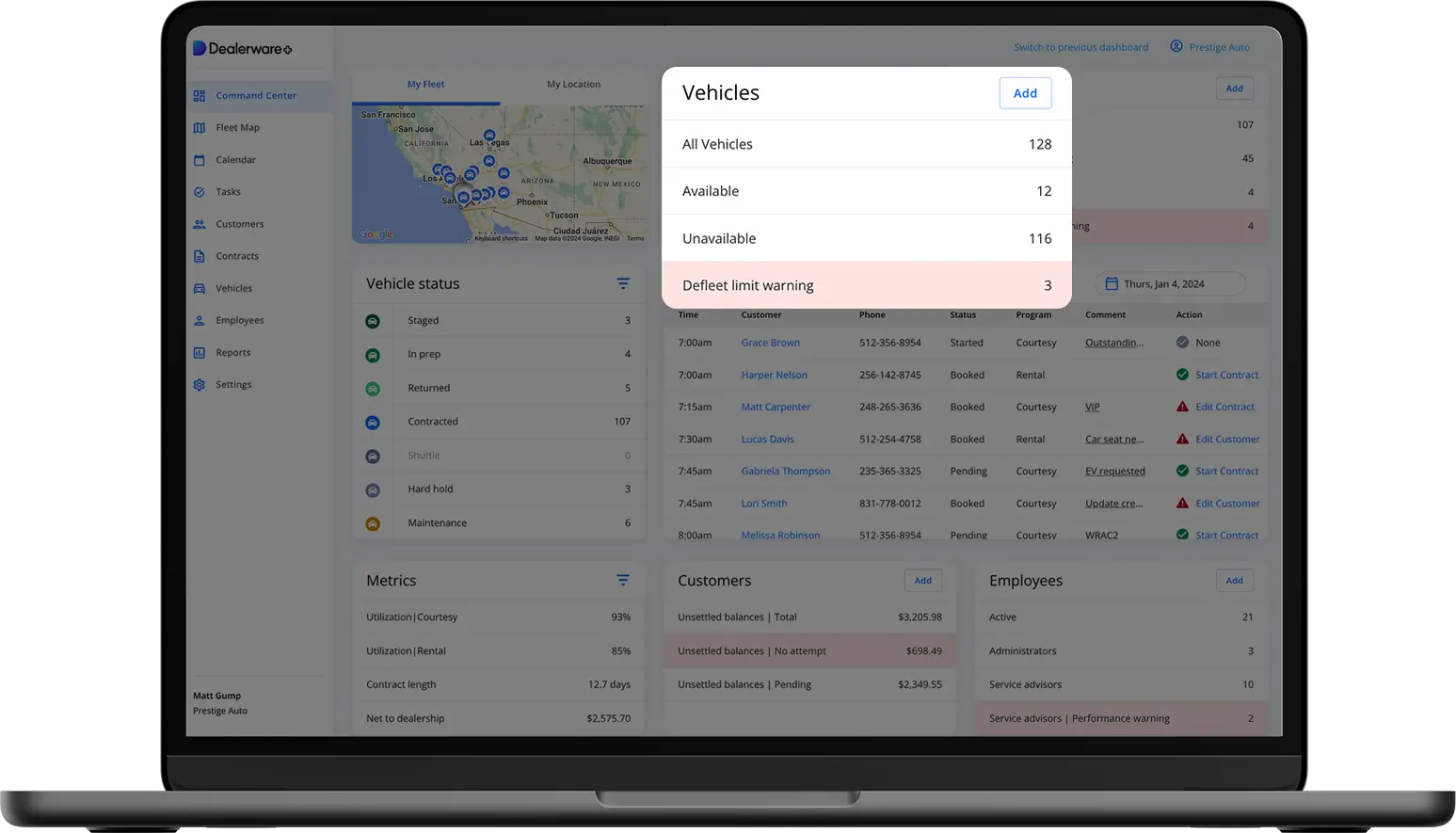

Protect your assets with vehicle telematics and GPS tracking.

Dealerware’s Connected Car Solutions offer GPS location services and ensure your most valuable assets are protected while mitigating total-loss claims. Tracking vehicles is simple with an interactive fleet map and alerts that notify you when a vehicle leaves the lot without a contract. Additional benefits include vehicle maintenance alerts and automated mileage and fuel reporting at contract close, which not only reduces error but saves time in the service lane and aids cost recovery.

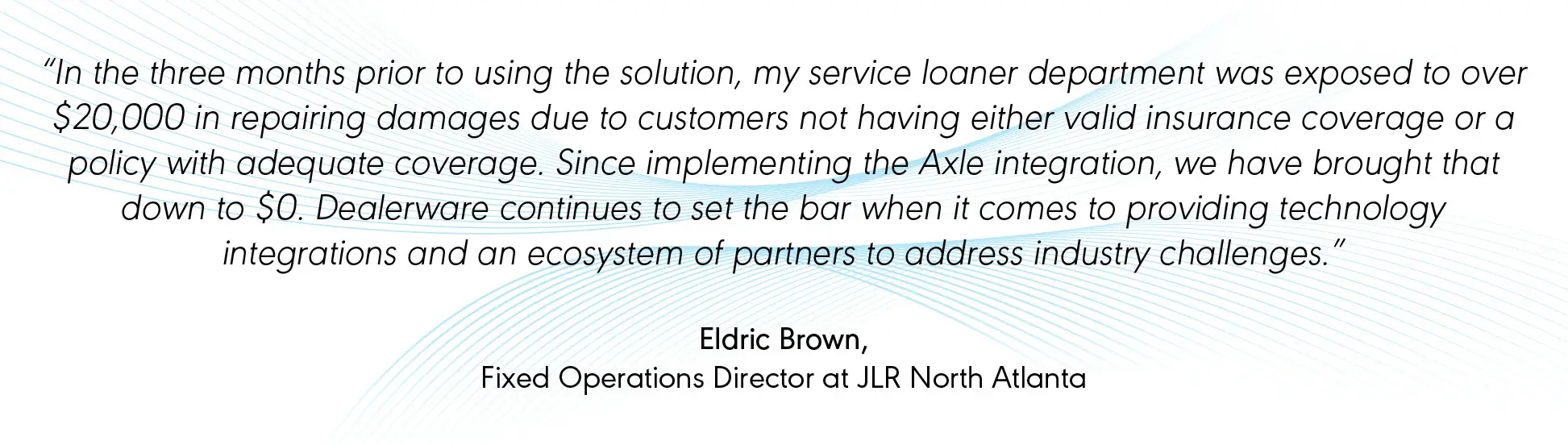

Eliminate risk and save time by instantly verifying customer insurance.

With Dealerware’s Insurance Verification feature, customer insurance information is instantly captured and verified before each contract begins, safeguarding your fleet, eliminating calls to insurance companies, and sparing you deductible payments.

The feature works by auto-texting the customer a link upon booking an appointment. After opening the link, the customer navigates through a quick and intuitive workflow where they can link and verify their insurance policy in seconds, without ever leaving the mobile web browser.

Plus, Dealerware’s user interface indicates whether the insurance details are valid and lets users view the full policy, taking the guesswork out of the process and providing dealers with peace of mind.

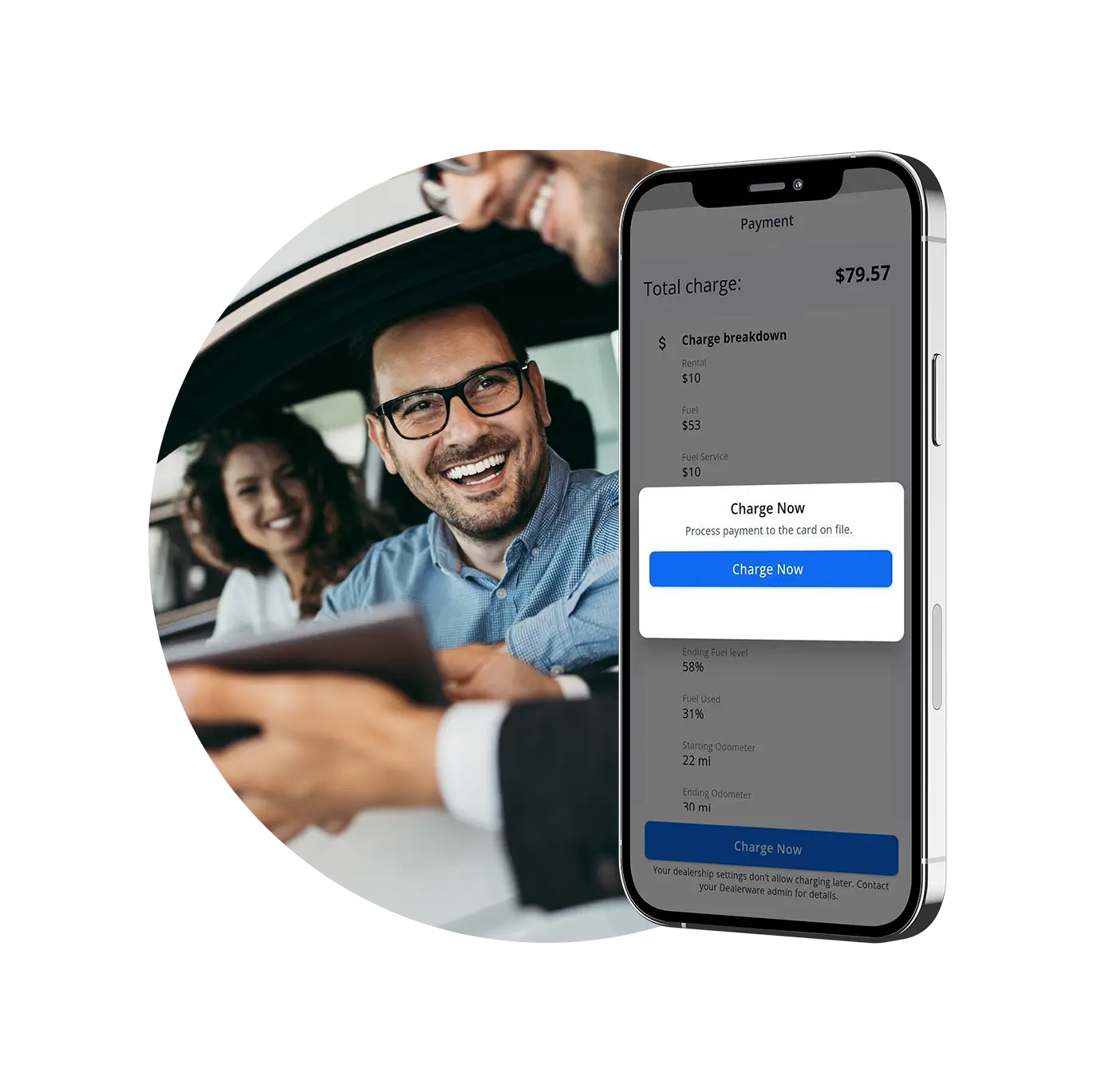

Customize and automate a billing engine that recovers costs for you.

Flexible Programs, a core Dealerware+ feature, streamlines your dealership’s payment processes and gives Fleet Managers the ability to group vehicles by source of business. Each program can be enabled to automatically capture daily rates based on vehicle model, fuel and mileage consumption, custom fees, and taxes for any contract assigned to the program.

Not only can Fleet Managers authorize 30-day credit card holds to cover moving violations or parking tickets, but they can also configure and automate multiple holds on a single contract. Furthermore, hold amounts and be customized as a flat rate or calculation based on contract days and daily rates.

Stay on top of outstanding customer balances.

Managing outstanding customer balances can be time-consuming, and delays in processing increase the risk of uncollected payments. Dealerware+ simplifies this process with its Unsettled Balance alert and report.

The Unsettled Balance alert notifies you via the Command Center when a customer has unpaid balances. By selecting the alert, you’re directed to the Unsettled Balance report, where you can quickly review the amount due, access the associated invoice, and manage the balance.

De-risk your program costs and maximize incentives.

Many OEM vehicle programs have specific guidelines, like vehicle mileage restrictions. By maintaining program compliance, dealers can qualify for incentives and maximize their returns on program participation. Dealerware’s Defleet Limit Warning feature, which lets Fleet Managers set mileage caps on program vehicles, simplifies the process of staying compliant. When a vehicle approaches its mileage limit, the Dealerware Command Center issues an alert, prompting you to quickly remove it from the fleet.

Additional features like Split Billing can streamline your invoicing process by splitting contract balances by multiple payer types or sources of business, where one payer might be a 3rd-party warranty company or OEM program. Through automation, you can bill customers for only what they owe.

Dealerware+ was built with the challenges of modern fleet management in mind, offering a suite of tools that help protect your assets, ensure program compliance, and streamline your financial processes to maximize incentives, empowering you to focus on what matters most—delivering exceptional service to customers.