Dealerware’s Insurance Verification has not only reduced liability, but it has also restored confidence. “We can’t control what happens once the car leaves the lot,” Roy said. “But we can make sure it’s properly covered. That gives us real peace of mind.”

After three loaner vehicles were involved in accidents on the same day, two without valid customer insurance, Chapman Ford Philadelphia was forced to file claims through its own policy, resulting in an estimated $10,000 in out-of-pocket costs. That was the moment they knew something had to change.

“We were already talking about insurance verification,” said Roy Fernandes, Fixed Operations Director at Chapman Ford in Philadelphia. “Then three accidents happened all at once. That made the decision for us.”

Chapman Ford has been using Dealerware software for three years, originally adopting the platform to gain better visibility and control over their fleet. The addition of Insurance Verification took that control to the next level. The dealership also implemented a strict storewide policy: if insurance cannot be verified, the customer does not receive a vehicle. There are no exceptions.

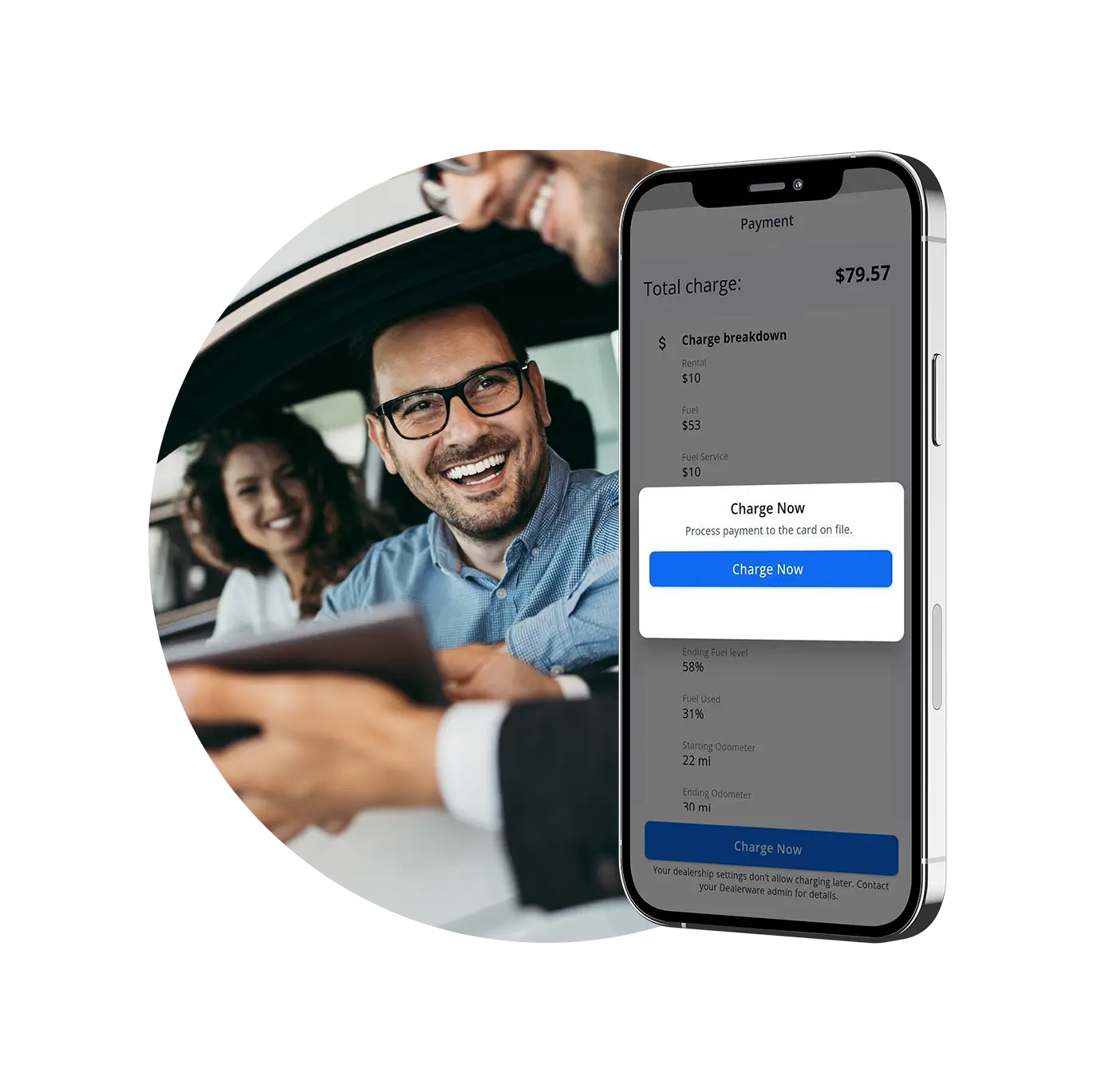

Since turning on the feature, Chapman Ford has seen dramatic improvements in both protection and efficiency. “About 90 percent of our customers complete mobile check-in with insurance verification before they even show up,” said Roy. “What used to take 10 to 12 minutes now takes just two. It’s a huge time saver.”

“Our service advisors now spend that time on higher-value work like calling extended warranties or helping walk-in customers. That translates into more repair orders and a more profitable store.”

Customer response to the new process has been overwhelmingly positive. “Once we explain that insurance is verified securely through a trusted third party, most customers are relieved,” said Roy. “They appreciate how easy and paperless the process is, and it actually builds confidence in our operation.”

With a fully integrated process that includes Connected Car Solutions, Toll Management, and mobile check-in, Chapman Ford has transformed its fleet experience into one that is safer, faster, and easier for both staff and customers.

Chapman Ford’s Transformation with Insurance Verification

Before Dealerware

⏱ Contract Time:

~12 minutes, gathering documents and customer info in person

📞 Insurance Check:

Manual, up to 20 minutes on the phone with providers

⚠️ Risk Exposure:

Up to $10K in uncovered losses from just one day of incidents

After Dealerware

⏱ Contract Time:

~2 minutes, completed in advance through mobile check-in

📞 Insurance Check:

Fully automated and built into the check-in process

⚠️ Risk Exposure:

Drastically reduced with verified insurance before vehicle handoff