In mid-July, we hosted a webinar to help Dealerware users review and better understand all the cost recovery tools available to them through the platform.

During the webinars, we took the opportunity to poll attendees and learn a bit more about the ways Dealerware supports dealerships’ cost recovery strategies.

Here’s what we learned.

The value of cost recovery

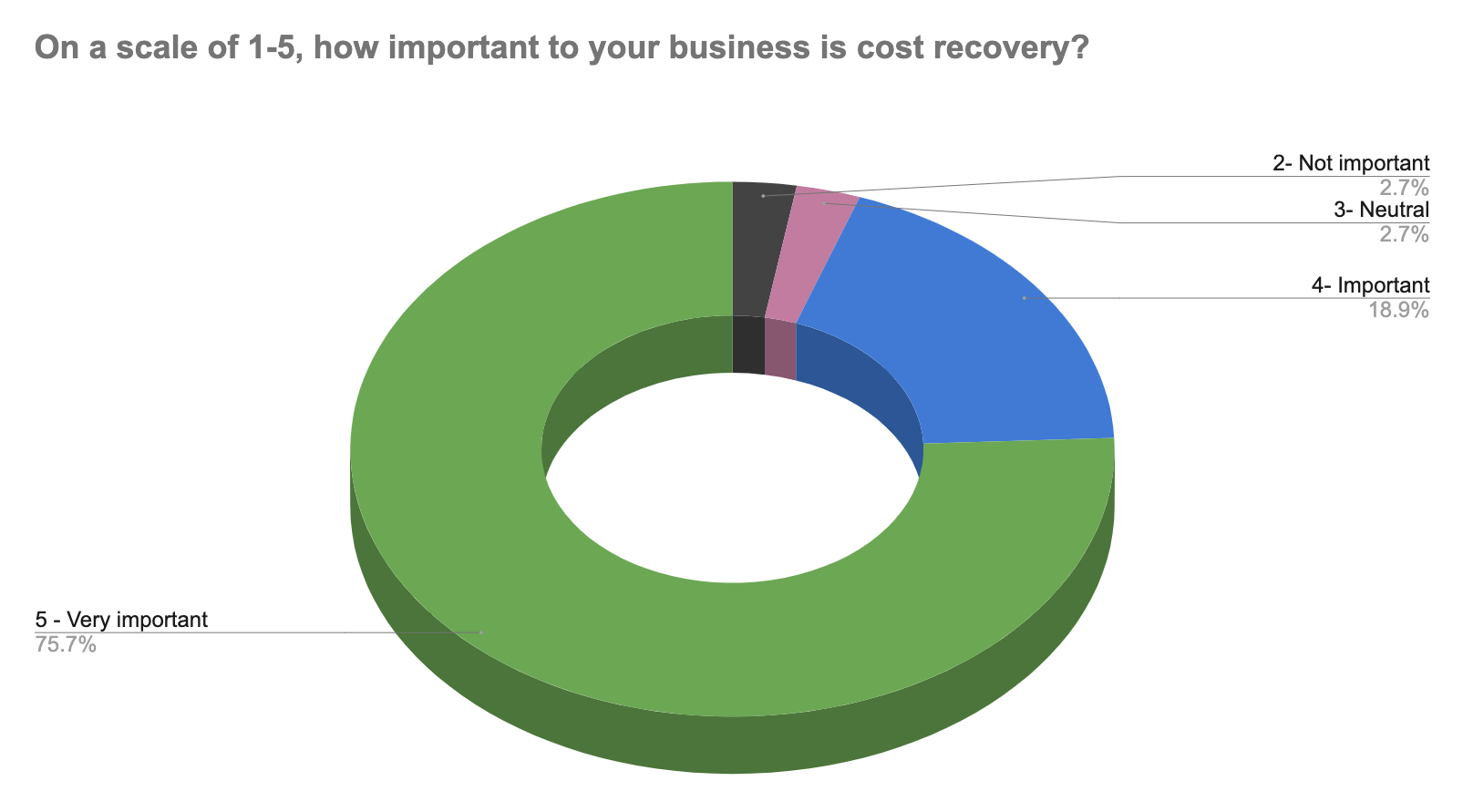

An overwhelming majority of webinar attendees said that recovering costs was very important to their businesses.

We know the impact of even simple cost recovery strategies can be significant. Consider the example we shared in a recent blog post examining the impact loaner fleets can have for mass market dealers:

Six cars used 55% of their available days are with customers for 99 days each month. A dealership that charged a middling rate – $25 per day – for access to these fleet cars would generate nearly $2,500 in new revenue from that fleet.

With that in mind, it wasn’t surprising to see that another 18 percent of attendees said cost recovery was simply “important.” In all, 95% of webinar attendees find plenty of value in recovering costs.

We suspect the other 5% of respondents either don’t recover costs, or so far have not seen a significant impact of their specific cost recovery strategy. For this latter group, we hope that our July webinars were helpful… and a recent influx of support tickets requesting further advice on how to adjust cost recovery strategies suggests we helped some dealerships recalibrate!

Cost recovery performance

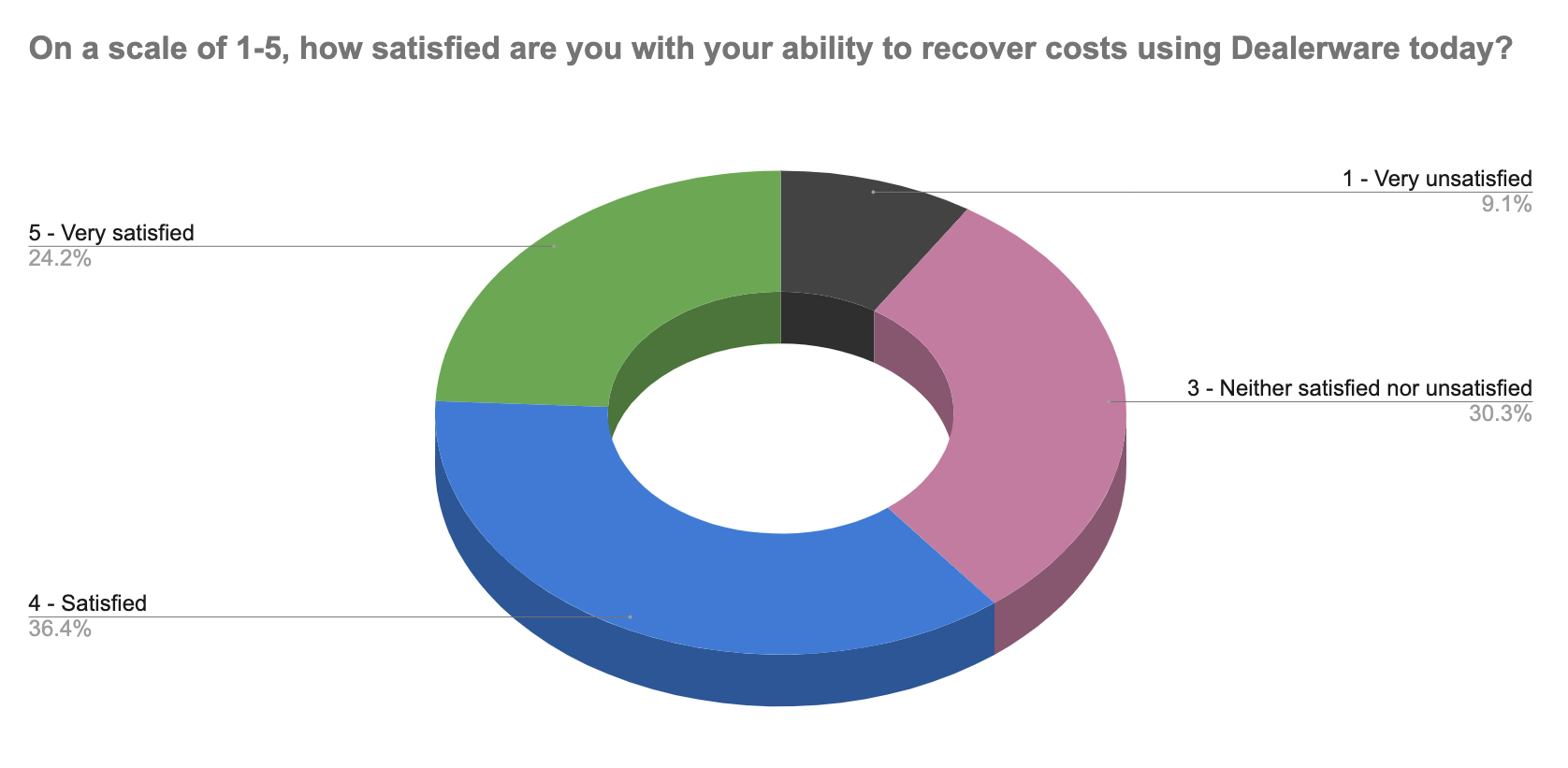

Lending credence to this theory are the 9% of respondents who said they were very unsatisfied with their ability to recover costs using Dealerware. Our team is very hopeful that these attendees came away from the July webinars with actionable advice for changing their cost recovery strategies.

We were also pleased to see that about two-thirds of our webinar attendees were satisfied or very satisfied with their ability to recover costs, and hope the 30% of respondents who provided a neutral answer learned how they could improve their strategies.

Unsettled balances

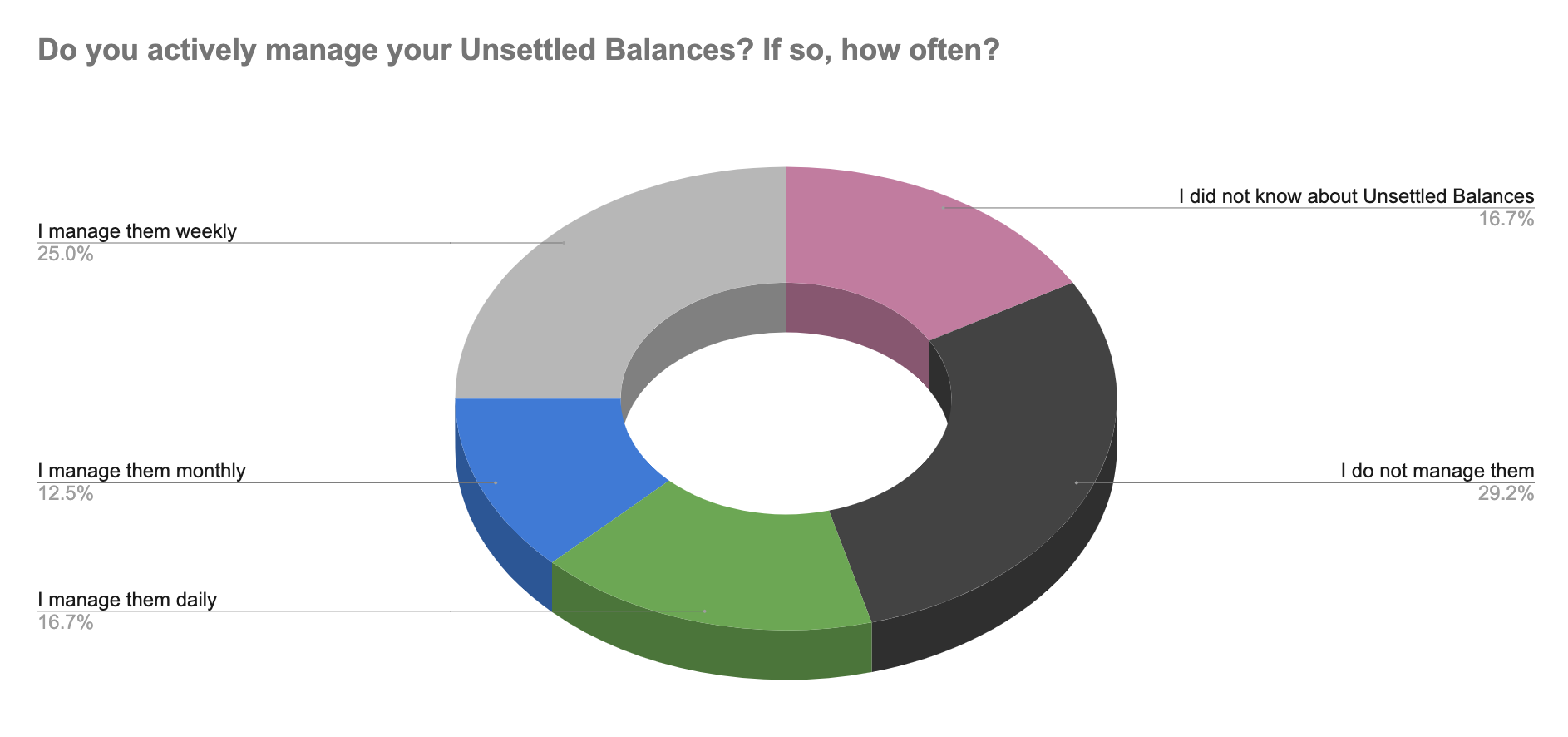

One of the best ways to improve cost recovery performance is to view and manage Unsettled Balances in Dealerware on a regular basis, preferably daily or weekly.

While more than half of attendees reported managing Unsettled Balances daily, weekly or monthly, we were surprised to see that 17% or respondents didn’t know about the feature at all.

Learn all about the Unsettled Balances filter, found within Dealerware’s Customers report, here: What are unsettled balances and how do I manage them in Dealerware Web? – Dealerware

The power of managing Unsettled Balances is multifaceted. For one, working through and collecting unsettled payments daily will prevent surprises for your customers. For any charges older than a day, customer contact info is provided right there, so you can reach out and inform your customer that you’ll be charging their card on file for something they agreed to pay.

Secondly, your dealership will recover more of the costs of operating a loaner program and may begin to generate revenue from the fleet. After all, most unsettled balances are for fuel charges that aren’t immediately charged back to customers, for one reason or another.

Dealerware’s mobile contracts make it very clear to customers that they’ll be charged for fuel, tolls and any other charge options you select. Our research shows that drivers read our mobile agreement summaries more closely than they would a paper contract. When charges are left unsettled for whatever reason, you have the tools to make sure you collect what your customers owe you. Don’t let unsettled balances linger!

Thanks to all who attended our Cost Recovery webinars and helped us to better understand how you use our tools. The Dealerware Customer Success team is always ready to help you make the most of Dealerware. For help with your cost recovery strategy, contact support@dealerware.com