Speakers:

Russ Lemmer

Trevor Gile

Moderator: Once again we do invite your questions, if you have one please write in on the card and one of our colleagues will pick it up and bring it up front. We begin. If I am a fixed OPs manager or a service director, I’ve got a thousand things I need to be doing immediately, and if I am told that another one of those things that going that’s going to the top of the list is managing a loaner fleet actively, I might be a little resistant to that. Trevor, did you get pushback from your service folks and from your fixed OPs folks when you brought this back in-house? How did you get the buy in?

Trevor: Absolutely you’re going to get push back until you show them how easy it can be because it doesn’t have to be complex it should only take a few minutes of their day to really evaluate because if you have the right tools you can see it. It’s not a big deal but with interest rates and everything going up if you don’t properly manage that fleet and have the tools to do it, you’re going to lose so much profitability, so everything you’re working for is going to be gone. So you gotta make it, literally, as painless as possible for them.

Moderator: Russ, what’s the impact of a badly managed loaner fleet? What can that do the detriment of a dealership’s operation rather than the benefit?

Russ: It costs you a lot of money immediately and it costs you customers over time. When we think about those three pillars of value, at the end. The first of those cost savings, if you’re not managing this well, what feels like $5 or $10 in fuel per contract seems like a trivial amount. When you put that across fifty different cars, that are loaned out seven times a month. That adds up really quickly, thousands of dollars a month going straight out the door in just fuel costs. And then if you have too many fleet or too many people trying to manage this process because it is manual because it is cumbersome; you’re carrying not only the cost of that fleet but all the remarketing risk that comes with pulling that car out if you don’t have the intelligence that we talked about, earlier. We’ve seen so many retailers that go and try to market these after the programmatic six months, however long they’re supposed to be in there they take in a market and they lose thousands of dollars because they’re contractually obligated to buy from a manufacturer, price X but they can only sell for price Y. Right so, they can get smarter about how they manage those assets, that’s a lot more money they can bring home. Then finally, it’s about the customers. Customers today are very trivial with their loyalty; they have very high expectations. If you make them wait, if you see their arms cross and their toes tap, you can feel CSI’s start to go down. That’s money out the door right now and potentially a lost customer in the future.

Moderator: Trevor, you mentioned earlier, that a loaner program is a way to get service customers into your new product at the dealership. Can you quantify how many sales, new vehicle sales come as a result of your loaner program?

Trevor: We haven’t directly tied to it but we know that consistently, I’d say, at least 5 to 8 sales a month off of it. If I was going to guess with it, but the main part about it, is that when you think about acquiring used cars is one of the most difficult things right now to being, right, and new cars are plentiful, we can replace them very easily and so by having put in new cars in constantly, you’re also helping your used car inventory. But sales wise we do, I’d say, it’s a safe number to say that your going to get at least 5 to 8 sales; if it’s done properly. And we’ve played with different things, we’re branding the cars different ways, to when people are driving it, we’re like a buy now kind of concept with it. I’d say in the next few months we’re going to really strong push on it there.

Moderator: Does that reflect your experience of what…

Russ: You know we don’t measure how many new cars sales come in as part of the service program; but, we do often see the more innovative dealers excited about a newer service program fleet simply because they get those customers, that have the aging inventory, into the newer models. They’re able to sell them on the newer features. What we’ve actually seen a lot, and you know subscription is a pretty hot word right now, is how do these customers, that come in and drive, let’s say an Audi Q7, when they typically have an older Audi A5. What if they just want to try that out for three, six, or nine months? There is really no program that offers that. Service loaners are actually interesting because one, you always want to get higher utilization but, you can start to monetize the slightly used vehicle at that subscription premium; and so as you think about managing those fleets and letting these customers stay in these cars for longer, starting to charge them revenue instead of just loaning them out. It’s actually a really interesting opportunity, not necessarily, to sell new cars but to generate new types of revenue at a higher margin on an existing fleet.

Moderator: Both of you mentioned the importance to customer satisfaction of not having a service customers sit around the lounge for a couple of hours, until he gets… His or her, vehicle back. Not having to arrange for someone to pick him up or whatever. Can you quantify what an effective loaner program can do to elevate CSI. Trevor, have you looked at that?

Trevor: Well I mean, like you (Russ) were talking about, every second they are waiting is drastically going to hurt it. But I mean if you had the choice to get into a rental car, that was dirty and low on gas, your score is going to drastically go down. And so getting into a new vehicle that’s properly maintained, that’s going to be a huge factor and making sure it gets done. So knowing the checks and balances is something, if your managing your fleet, you got to make sure that every time it’s going out, it’s best foot forward on there.

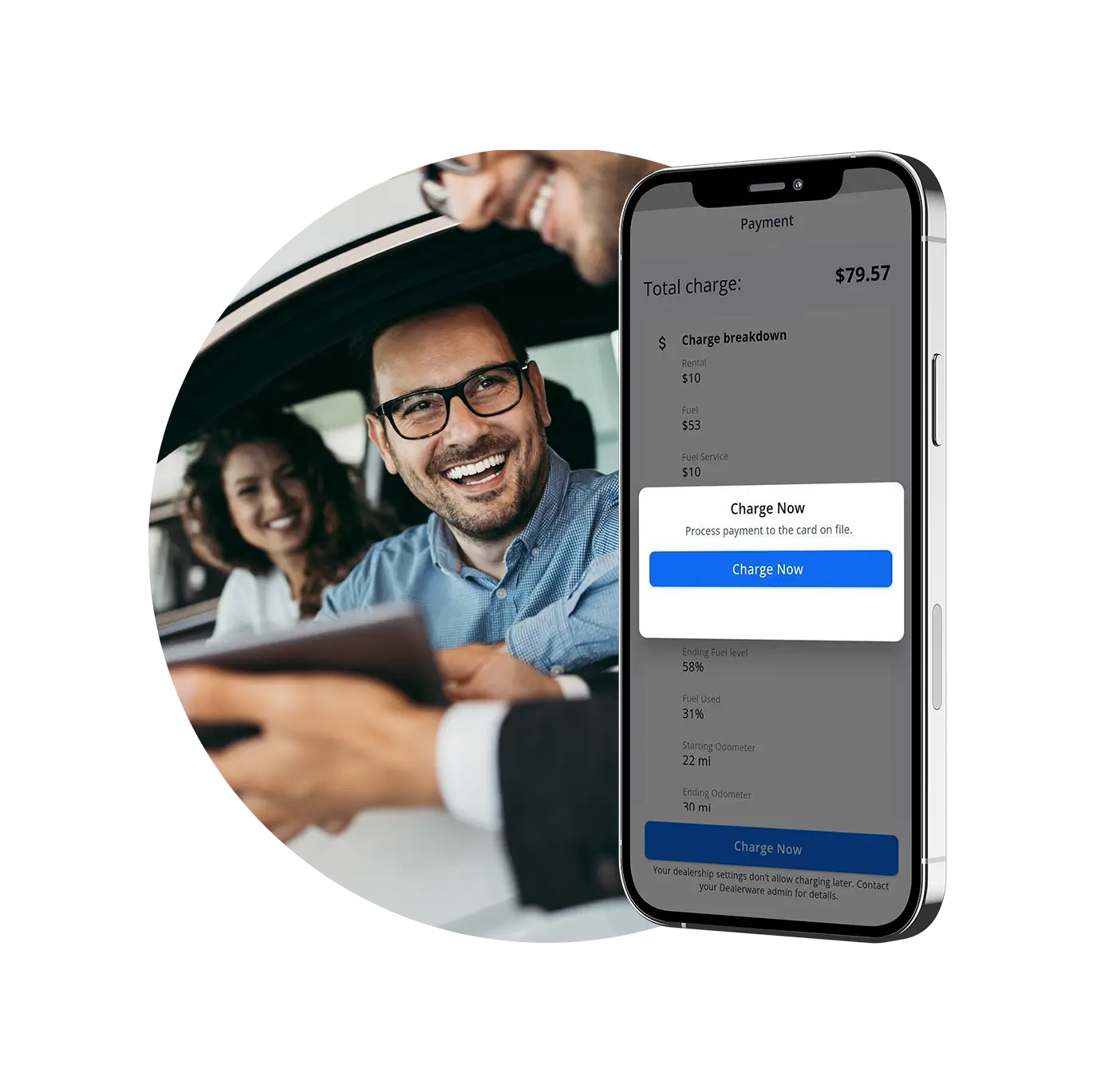

Russ: So we’ve seen the challenge there in quantifying that there is no CSI question we’ve seen directly related to loaners, so it’s tough to tease out the direct impact. What I can tell you is we know… We manage tens of thousands of vehicles for hundreds of dealerships all over the country and we charge these customers, as we’ve talked about, for fuel, and tolls, and all the usage; and we haven’t seen CSI go down. Right, so we’ve transferred more than two million dollars from customer wallets back into the dealer. P&L and CSI scores have remained constant. The other things you are able to do with the modern program, are things like pick up and delivery. Right, creating that out of dealership experience, where you don’t have to wait in the customer lounge but I can actually bring you a loaner, open up that contract on the mobile device, bring in your personal car for service and then come back out the minute your car is done and you never have to leave your couch. That actually be seeing not only CSI skyrocketing when you’re able to do that, but you see average RO sizes that are up 200% to 300%. Customers are much more willing to give your their money when you give them their time back.

Moderator: Trevor, does Motorcars offer valet service?

Trevor: We do not. We found for the liability of driving back and forth, the less we cut on that, it’s more important for us. And I think as times are changing the number of employees you have is going to keep on dwindling further and further down; and, that’s where for us, one of the reasons we really wanted to build that software is we wanted to make sure that we weren’t adding a rental car manager. We weren’t adding that because I mean I can can see maybe doing like an Uber or Lyft, to pick somebody up, might be a way to do it. But, the time to send somebody out, then it’s… If you send somebody to do that, it’s normally a valet and that means that you’re losing that person somewhere else in the dealership and so if you can have people assigned for the exact areas, you’re going to be a lot more efficient, a lot better off on there. I think, I know, like we actually looked at doing Uber and Lyft more involved in it and I think the problem is the customer gets stranded and so a lot of times dealers are like “oh will we’ll just go with a smaller loaner fleet and we’ll just pay for Uber and Lyft.” I think that’s a ways away because if people have extended a day or two, they’ve got to get back on here and then also your cost starts shooting up on there. As opposed to having a couple more vehicles in your loaner fleet, that you’re depreciating that turns into inventory. One of the real quick thing I wanted to make sure I mentioned is that we learned the hard way too is, what vehicles you put in your loaner fleet. When we went from 28 to over 100, we literally just took all of our inventory and next thing you know I think I even saw a C or Z go in there, that was probably like 700 days old and it was so difficult to get that thing out of there; and so when you put vehicles in there you can’t let the new car department decide what goes in there. You got to let the pre-owned manager be involved with the service department, and based off of needs and what you feel is going to be best to get rid of. So you have to have an exit strategy before you actually put the vehicle put the vehicle in the service the loaner program.

Moderator: Well that segways into a question from the audience, for Trevor. When a loaner car is sold, who get the profits? Service or sales department or who?

Trevor: It goes to the sales department. We feel that service, they should be able to… They’re getting new cars with the lower maintenance because they don’t have the ones they’re aging. Where all of a sudden they have to put brakes and tires on there. And if they properly manage the tools like they have it… It shouldn’t be an issue for them to make sense to have it in-house there and used cars, we feel like if they’re the ones that are going to monitor want to pull those out faster, or service, otherwise it’ll just linger. And so having that one used car manager, that’s focused on buying cars constantly, going to Mannheim or other auctions to buy it. This is just another extreme to pull from.

Moderator: Pulling from the question, for Russ, actually for the both of you, how do I determine how many loaners I need? Is there a golden mean or a formula to apply?

Russ: Yeah there’s… It can be complicated if you make it complicated. You can have a little calculus involved. Typically, the way it works is, it’s different for luxury then it is for mass market, it’s different for warranty claim then it is for third party pay. So you can calibrate different models, there is no hard and fast rule and it’s something that we help the dealership actually calculate and we first set them up. What are your borrows; what are your average cycle times on those borrows; how many customers request or need loaners and if you run those three variables, you can start to figure out how much fleet you actually need by setting a target utilization. Setting a target utilization of 100% is actually a bit of a fool’s errand because you’ll either run out of inventory, you’ll never actually get there, you’ll be frustrated. Typically, we’ve seen best-in-class, typically, about 85% to 95% utilization. You’re always going to have that one customer that wrecks one of your cars. You put that in hold, it’s in the body shop, it’s got to be repaired. So you’re never, actively, going to be using the entire fleet, but those are the three variables that I would look at. Number of ROs, duration of ROs, percentage of people that need loaners, when they come in, and then hit a target utilization rate and the math will take care of the rest.

Moderator: Trevor, how do you…

Trevor: We look at pretty simple is that, obviously, the less cars you have in there the better. And so by tracking each day ,like in our system, it tracks each day how many were rented out versus how many were available and look at that spoilage. That was the slides I had and it’s okay to, when you trim it down to get where maybe… The way we looked at it, if there’s 3 or 4 days in the month that you would have needed to get another car, it’s okay to call Enterprise or Hertz and get it for those onesies, twosies on there because it’s going to be saving you $400 to $470, depending on your model a month in rental vehicles. And so we kept pushing down and down and down every single month, trimming to the point where it was… It got to from like I said from one of ours was 45 to 13 within 9 months on there and so if you look… If you’re holding the advisors accountable, where you don’t have to spend a lot of time. If they know you’re watching them, they’re going to not pass out as many loaner cars; and then all of a sudden going to have less people staying in the cars as long and then you’re able to drastically trim down on there and that’s where we’ve been able to make that $90,000 a year savings.

Moderator: I think we have time for one last question. As we look to the future, the movement to autonomous vehicles, electric vehicles, subscription services. How will the model of the service loaner program change with these developments?

Russ: I think you’ll see more uses for what dealers will more generally call the mobility fleet. Right, so there will be somewhere customers don’t pay their the service loaner. I bring in my car– I still own my car– and I need an alternative form of transportation, you give me that service loaner. But, I think you’ll start to see dealers become more like mobility hubs. If I’m in an urban environment and I need a retail rental or I do want to subscribe to an SUV for a couple of months; because, I live in Denver and it’s the winter and I want to go out to the mountains, you know for the snowy period. You will start to see people repurpose, the quote-unquote, service loaner to mobility fleets and you’ll start to see them be used in a number of different ways from warranty repair, all the way to subscription and customer pay models. I think with autonomous, nobody really knows yet. We love to theorize and write out things on whiteboard and make big bold headline statements. How that affects that dealers is somewhat unclear from a customer perspective and a particular service loaner perspective. But, it’s clear that even when these autonomous vehicles are running they’re going to need to be repaired and serviced at some point; and no better place to do that then the mobility node that already exists, which is your local dealership. So we see while there will be fleet managers out there and maybe dealerships will have, in 20 years, fewer direct customers. They’ll have the majority, if not all the lion’s share of that service revenue, that comes in from these autonomous fleets.

Moderator: Trevor, how was Motorcars preparing for these development in the service program?

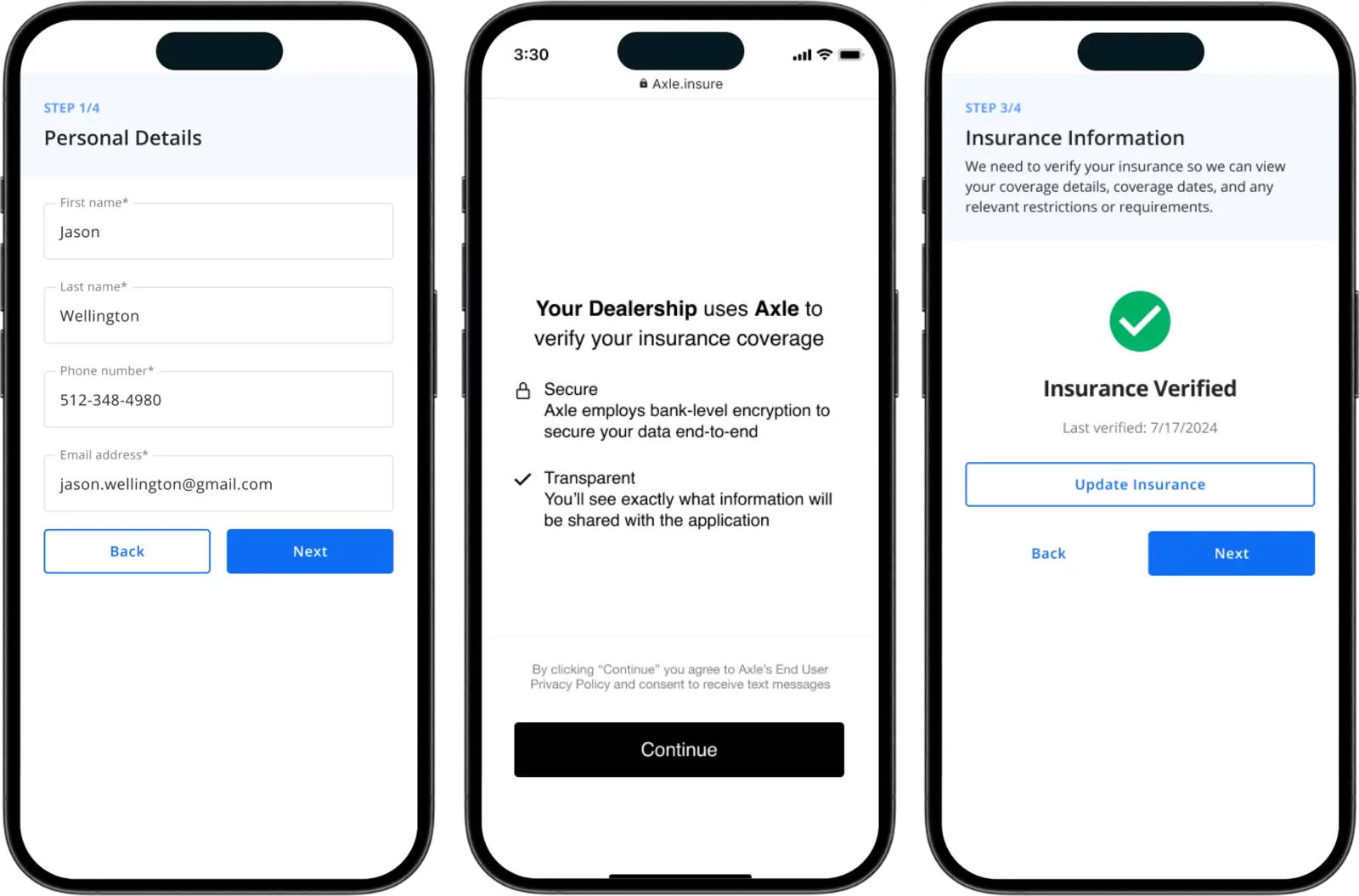

Trevor: Loaded question. We know that change is coming. I mean the business says where the revenue streams are going to be coming, are drastically changes; and so I look at the rental fleet management is kind of like a baby step to ride-sharing, if and when or when it happens. But, there’s a lot of factors that go into that and autonomous cars; but, we focus on trying to, like I mentioned before, is taking the revenue back into us. Where we have an Allstate agency that it confirms insurance when somebody buys a vehicle. We built these huge car washes that can do up to a 100 to a 120 an hour with two employees, there were generating revenue that was going somewhere else. The rental car is another one; so, we feel that if dealers start focusing on trying to take back on some other avenues, “that’s how we’re going to survive.” Otherwise, it’s going to be very very difficult and so because there’s too many unknowns and so there’s… But, there are things that you can control and that’s like the cost of the car washes, the insurance, the rental fleet. Ones that it’s a huge part of our success and those are the fastest-growing thing in any of our companies.

Russ: I might punctuate that with a quick observation. Is that Autonomy doesn’t really have to be a scary or even a dirty word. I mean, to me, it already exists. Like when we wrap up here and I make my way to the airport; I’m going to get an Uber or a Lyft and when I get in that I’m going to look at my phone, I’m not going to pay attention on the road. I’m going to be driven autonomously, so to speak, to the airport. That car still needs to be service, that car needs to be owned by somebody. So in the future, if that driver is removed, it’s still the same customer experience for me and it’s still the same type of fleet vehicle that will need to be serviced. So I don’t think it is this dystopian future, where there are no drivers and there are no people. I think it’ll look and feel a lot like today. You’ll just have a more diverse collection of vehicles that are slightly modified to account for driverless opportunity.

Moderator: Okay. Gentlemen, thank you all to seeing our time is up but show your appreciation for a stimulating discussion.