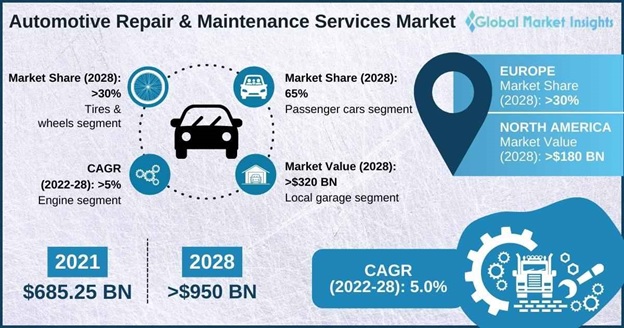

Consumers are holding onto cars longer than ever. The average age of vehicles registered in the U.S. is about 12 years. Continuing supply chain challenges amid a tough economy are pressuring new car sales even further. As a result, automotive maintenance needs are expected to increase steadily over the next 5 years due to aging vehicles on the road. According to Global Market Insights, the automotive repair business reached over $685 billion in 2021 and is estimated to grow to over $950 billion by 2028.

It’s a competitive market, and new-car dealerships are outnumbered more than 10-to-1 by independent repair shops. How can the dealership service industry retain out-of-warranty customers and even win service department customers back from independent repair shops?

Why service department customers are seeking independent repair shops

According to the Automotive Management Network, there are three things service department customers look for in a service provider: expertise, trustworthiness, and convenience. Dealership service providers lead the industry on all three.

Unfortunately, customers only ever see the final bill, and the expertise dealership service delivers usually comes with a higher cost. Dealership technicians have better training, manufacturer-specific tools, and factory parts, after all. So while it is common for consumers to use the dealership for service while repairs are covered under warranty, many sacrifice expertise and even convenience to seek cheaper alternatives once they’re out of warranty or their service contract expires.

That gives independent repair shops, on average, nine years of potential business with customers who leave a dealership after their warranty expires. Moreover, independent repair shops are now taking cues from dealer service strategies in order to build loyalty and earn as many repair orders as possible from customers with aging vehicles. In an effort to compete on convenience with dealership service departments, independent repair shops, and collision centers are now offering loaner and rental options to their customers. This is a convenience customers have come to expect to keep their lives moving, and a powerful differentiator between service providers.

How to retain service department customers after warranties and maintenance programs expire

To increase customer retention after warranties and maintenance programs expire, dealers need to explore ways to increase the convenience associated with coming to the dealership for service. This can be as simple as making the loaner car process easier and more visible on the dealer website, or as innovative as providing ways for service department customers to customize their loaner car experience, turning a service visit into a long-term test drive of a new model. Research shows that keeping customers in the vehicles your dealership sells builds brand loyalty and makes it more likely they will return to your dealership for future vehicle trade-ins and purchases.

Consumers know that the dealership is much more likely to have a loaner car for them when their car needs service. However, as mentioned above, some independent shops are beginning to take cues from dealerships, offering loaner vehicles to try to win as many of each customer’s service dollars as possible from years 3-12 of the average vehicle lifecycle.

Service department customers favor reliable loaner and rental programs

The problem for independents, however, is they have limited loaner and rental vehicle availability since they need to purchase used vehicles specifically for this purpose, or they need to rely on rental car providers to deliver this level of service. This gives dealers the upper hand. They can use new-from-the-factory vehicles as loaners to elevate the service experience for customers, they can maintain brand loyalty and a strong customer base by offering discounted rental options to service department customers with expired warranties or service contracts, and they can offset the costs of operating a fleet by selling loaners at a premium once they hit a predetermined mileage or equity threshold.

Providing this convenience for the consumer is also a lucrative investment in future sales for the dealership. For example, a customer that brings in a three-year-old vehicle for service and gets a brand-new loaner car may decide it’s time for an upgrade. This is a win-win for the dealership: a new car is sold, a used car is now available for resale, and the great service experience that convinced the customer to trade up will keep them coming back for future service.

Reduce friction for service department customers by streamlining operations

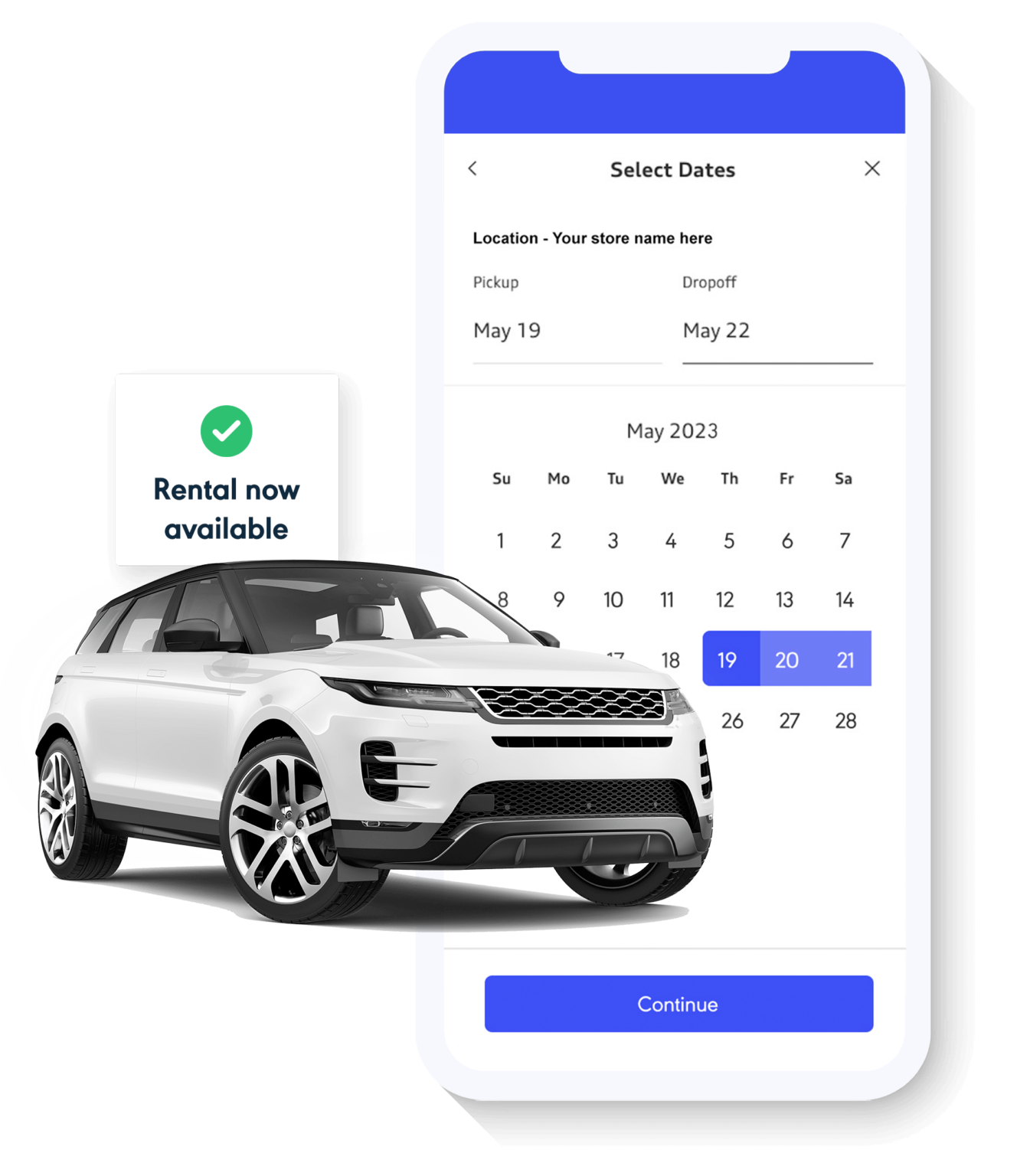

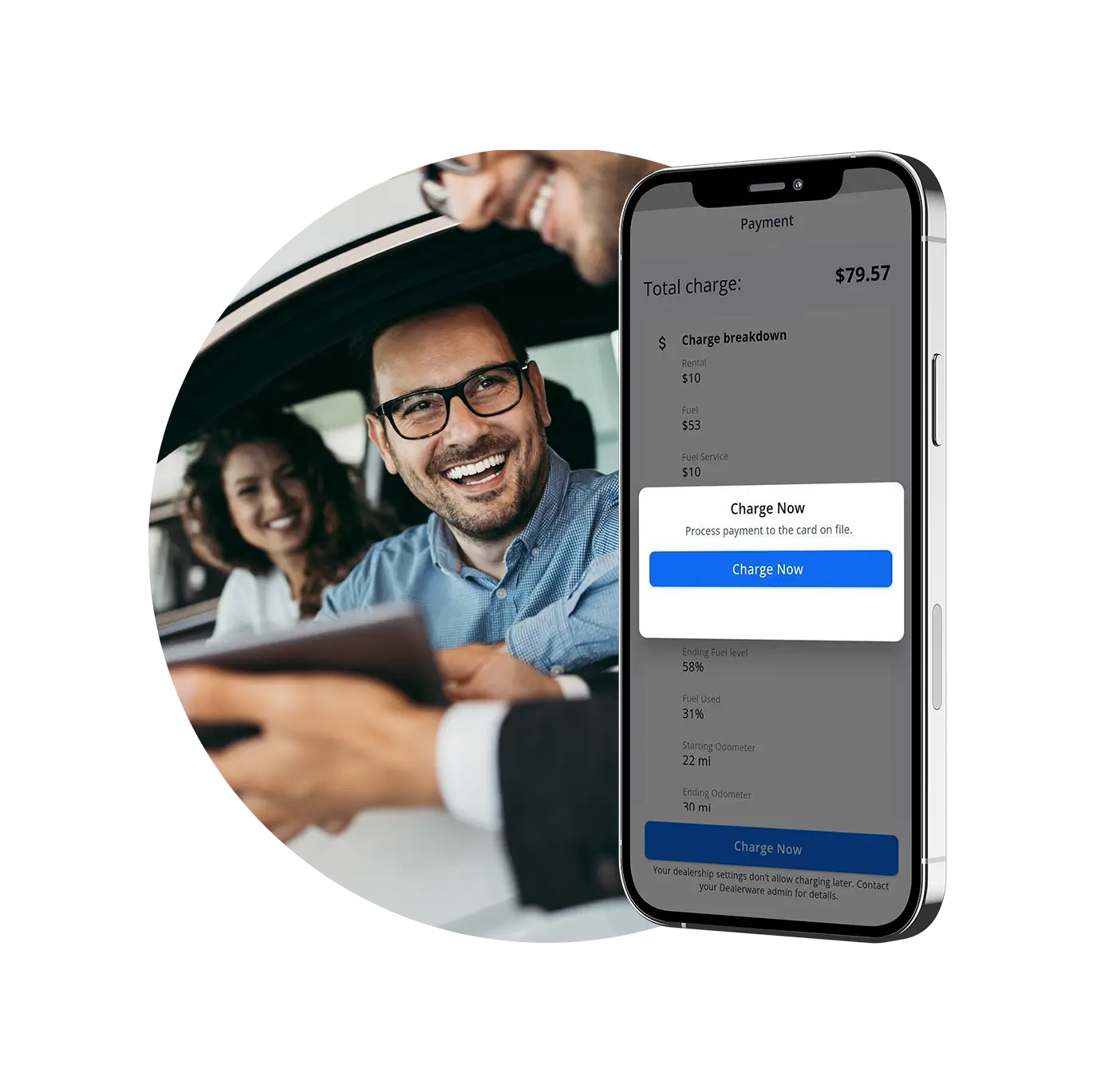

It’s also worth considering that customers will pay for added convenience. Dealerships with the right mix of loaner cars have an opportunity to capitalize by charging a daily rate for shorter-term loaner contracts or even on-demand rentals. Managing loaner and rental programs can seem tedious and time-consuming, but fleet management software can help streamline and improve the process removing any of the friction associated with offering these programs to your service department customers.

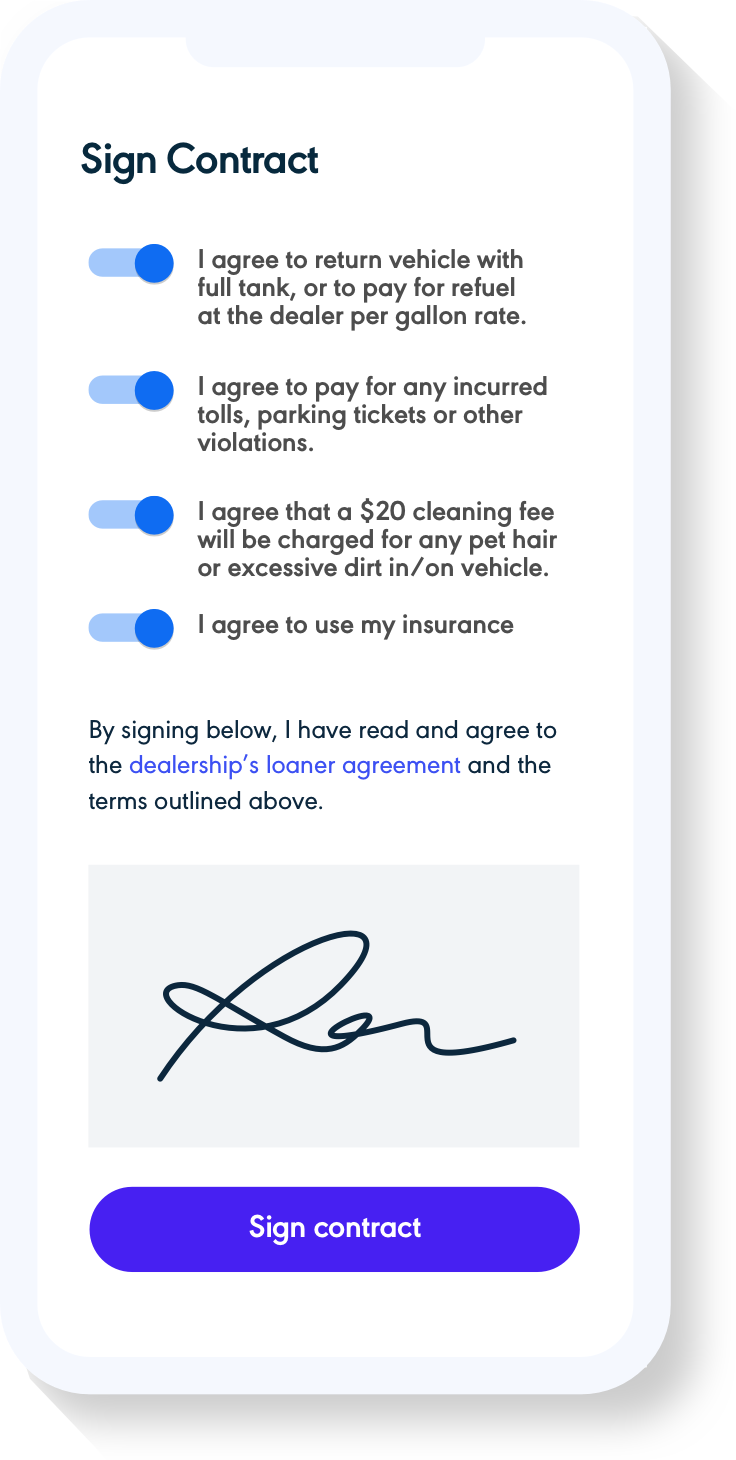

The most common complaint from customers in dealership service centers is the amount of time and paperwork it takes to drop off and pick up their vehicle. Customers have to come into the service reception area to complete their loaner contracts and then again when they return to pick up their repaired vehicle. An easy and affordable solution is available on the market to remedy this problem. Loaner and rental fleet management software developed specifically for the unique needs of the dealership can not only save service advisors time but can also help dealers recover costs associated with offering courtesy vehicles.

Fleet management software solutions to help you retain service department customers

There are a number of fleet management software solutions available and finding the right one can be daunting, but dealership management will see a return on investment almost immediately after implementation. When considering a fleet management software solution, the following features and functionality should be considered as they will reduce friction for service department customers and streamline your operations.

- Reservations and Daily Schedule – Create current and future vehicle reservations and quickly view real-time fleet utilization and vehicle availability, helping to increase the number of customers served on repair order totals.

- Vehicle Groups with Daily Rates – Utilize vehicles for both loaner and rental programs with discounted daily rates for customers out of warranty, ensuring customers keep coming back even after their warranty expires.

- Telematics with Off-lot detection – Save time, reduce human error, and maximize cost recovery with automatic fuel and mileage readings while also mitigating risk from incomplete contracts, employee misuse, or even theft with GPS tracking enabled.

Implementing fleet management software with these key features will save service advisors time on every single loaner contract, and will decrease customer wait time to minutes, improving customer experiences and satisfaction scores.

Offer service department customers Pick-up and Delivery Services

Take convenience to a new level with pick-up and delivery options. People are busy and the easier it is to get vehicles serviced, the more likely customers are to keep coming back.

Pick-up and delivery services provide customers the flexibility to have their vehicle serviced without the inconvenience of having to take their vehicle to the dealer. According to RedCap, dealers who offer pick-up and delivery see a 33% increase in repair order profit, a 33% increase in customer retention, and a 99% customer satisfaction rating.

Delivering completed vehicles back to customers already in loaners can be an easy win for dealers and a convenient option for their customers, too. Offering to take payment virtually or over the phone and delivering a finished vehicle to a customer’s home or office is an opportunity to demonstrate the value of customers’ time while also increasing workshop throughput, loaner fleet utilization, CSI, and most importantly, profits. Successful and consistent pick-up and delivery options create convenience that drives service loyalty long past a customer’s warranty period.

In Conclusion: How to retain service department customers

Dealers who implement loaner and rental programs with fleet management software like Dealerware will keep service department customers coming back beyond their warranties and service contracts. Dealers that go the extra mile to offer pick-up and delivery services will keep their service lanes full. They will also drive increases in revenue, cost recovery, and customer loyalty.

Dealerships already lead the service industry on expertise and trustworthiness, so increasing convenience is key to keeping customers coming back. Implementing these simple solutions will ensure dealership service departments never lose another customer to an independent auto repair shop.